Recently, the panoramic camera market has witnessed the emergence of a “data Rashomon”, adding fog to the already fiercely competitive consumer imaging track.

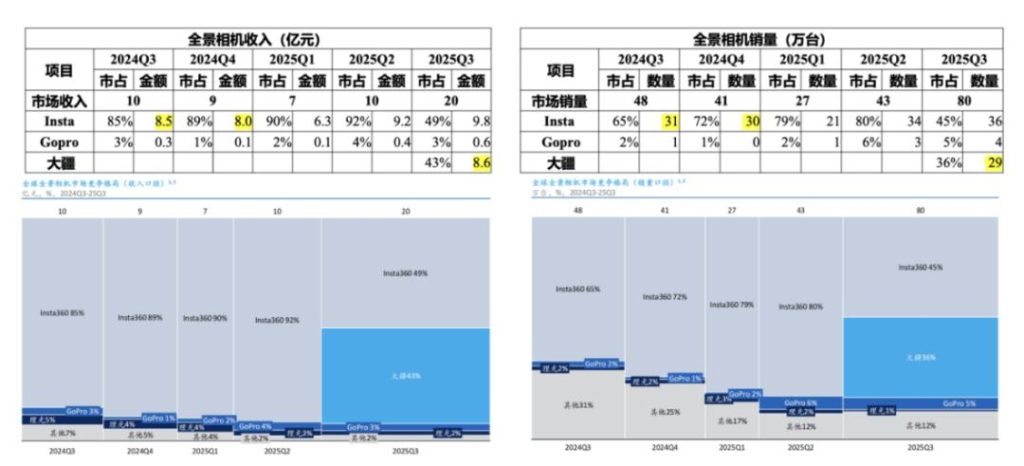

Not long ago, the third-party organization Jiuqian Consulting released a research report on the global sports and panoramic camera market in 2025. The report shows that DJI’s global revenue share in the field of sports cameras has steadily climbed to 66%, ranking first in the industry worldwide; In the new field of panoramic cameras, DJI’s first product, Osmo 360, has been on the market for less than three months and has captured 43% of the global market share, causing a sudden change in the player landscape.

A few days later, Sullivan released a report that presented a different picture – DJI’s market share in the panoramic camera field was 17.1%, and the data of sports cameras was also halved. What is even more puzzling is that according to media reports, the report went through two “takedowns” after its release due to reasons such as “internal data verification” claimed during interviews, and to this day, the download portal cannot be found on Sullivan’s official channels.

Faced with the controversy caused by market share data, 36Kr interviewed relevant personnel within DJI. It was revealed that “after seeing two reports with huge differences, we immediately traced and deduced the statistical logic of both parties’ data. Our Q3 panoramic camera shipments did indeed exceed 300000 units. It is understood that Jiuqian’s report is based on information input such as disclosed data from listed companies, actual sales data from mainstream e-commerce platforms, and extensive social media listening.

To further verify the reliability of the data, we also simultaneously checked the prospectus of Yingshi Innovation. According to the prospectus of Yingshi Innovation for the year 2024 and the first half of 2024, Yingshi’s revenue in the second half of 2024 is 1.65 billion yuan (24 year annual sales – first half sales: 2916.3689 million yuan -127.0264 million yuan), with a sales volume of approximately 620000 units (1.65 billion yuan/2641 yuan per unit), which is basically consistent with the data in Jiuqian’s report.

In addition, Yingshi also responded to the recent financial report briefing, stating that “the accuracy, completeness, and authority of some third-party data cannot be verified, reminding investors to pay attention to risks

Behind the difference in data between the two reports is a facet of the industry’s discourse power struggle. When the market enters the ‘Chinese time’, competition is no longer limited to products and sales, but extends to the formulation of standards and cognition.

In the field of sports cameras, the long competition between DJI and overseas giant GoPro is a typical “hardcore breakthrough”. After about six years of technological iteration and market expansion, DJI gradually completed the role transition from “challenger” to “leader”.

However, when a company’s long-term endurance breaks through the critical point of quantitative change, the technological and brand momentum it releases will far exceed the competition of a single product line and enter the stage of diversified product ecological layout. This qualitative change effect will be particularly evident in DJI by 2025.

From patient entry to efficient breakthrough, reviewing DJI’s journey in the field of sports cameras, we will find that the growth potential of a technology company may not lie in the initial speed, but in the acceleration of each “key entry”.

And the answer to this competition about market share may have already been written in consumers’ cognition and choices.

Behind the ‘Blitzkrieg’

From the rapid breakthrough between Osmo 360 and Osmo Nano, it may seem like a successful “lightning battle” on the surface, but if we examine the technological breakthroughs behind it, we will find that it is a gradual and qualitative change triggered by quantitative changes. The rapid rise of these two products in business is not accidental, but rooted in DJI’s six years of continuous exploration and technological accumulation in the field of sports cameras.

Osmo 360 panoramic camera, Osmo Nano wearable camera

The “fast” seen in the market comes from DJI’s slow pace in product iteration. The lightweight form and stable performance presented by Osmo 360 and Nano are not achieved overnight, but gradually mature along a technological path of continuous trial and error and evolution. This also witnessed DJI’s transformation from a challenger in the sports camera market, gradually accumulating to a definer.

Looking back at its development trajectory, a clear path from entry to defining the market is evident.

In 2019, the first generation Osmo Action product solved the core pain points of users in shooting scenes with its front color screen and stabilization algorithm, successfully opening up a market gap. At that time, DJI was already pondering a more futuristic question: what should a truly simple and easy-to-use sports camera look like?

The issues include how to break through the bottleneck of existing motion cameras, how to achieve dual screens, better waterproof performance, and lighter size in technology, how to attract more high-quality users and lower the threshold for the audience in both product ecology and market pricing, and so on.

Subsequent generations of products have been a continuous response to this issue. The Osmo Action 2 of 2021 no longer follows the traditional “all-in-one” design logic in the industry, but adopts a magnetic snap fastener architecture, achieving instant disassembly and replacement of the host and accessories. This modular design greatly expands the application scenarios and playability of motion cameras.

However, the overly innovative breakthrough configuration design was well liked by users, but due to the hardware specifications and capabilities of Action 2 at the time, the high specification overheating problem of 4K120 could not be solved, resulting in continuous negative effects. This also made DJI learn from the pain and decide to take steady steps.

This setback also became a crucial turning point, and in the subsequent Osmo Actions 3 and 4, DJI demonstrated a more pragmatic strategy, addressing the stability pain point of long-term recording. DJI did not give up innovation due to its dual nature, but chose to seek the best balance between “disruptive forms” and “user core experience”. In 2023, DJI, which had released the Osmo Action 4, finally maintained its market share on par with GoPro. Two years later, the emergence of the Osmo Action 5 Pro further transformed the accumulated internal iteration mechanism of the product, which is the ability to quickly and accurately identify user needs, translate them into product features, and connect with each other in the accessories, quick release, and audio ecosystems. Since then, DJI has led DJI to achieve a magnificent comeback in the field of sports cameras.

Osmo Action 5 Pro

Looking back at DJI’s six-year history of tackling challenges, we will find a principle: true innovation often lies not in the flashy skills of individual technologies, but in the systematic capabilities formed through continuous iteration. Not pursuing short-term returns and daring to invest in foresight is a sign of a mature technology enterprise ecosystem. Therefore, in this process, DJI has built not only a single device product line, but also a complete, efficient, and low threshold creative system. This is an ecological barrier that is more difficult to replicate than parameter stacking.

Ecological ‘compound interest’ and integrated experience

The systematic maturity has driven DJI to extend its product layout to more diverse scenarios. Nowadays, whether it is the thumb camera Osmo Nano that pursues ultimate lightweight or the panoramic camera Osmo 360 that breaks the traditional perspective, their success in the market no longer depends on the advantages of a single product, but is rooted in the support of a complete ecosystem behind it.

Osmo Nano can be seen as a mature transformation of DJI’s thinking on magnetic architecture. It inherits the convenience concept of Action 2, but through its ultimate lightweight design, imaging core that is in line with flagship sports cameras, and thoroughly optimized battery life and heat dissipation, it has been created into a “pocket professional phone” without any shortcomings. In addition, after four years of “idealistic” innovation in Action 2, DJI users finally welcomed a higher level of magnetic architecture experience. While the buckle is secure, it also significantly improves issues such as heating.

At the same time, Osmo 360 can also share Osmo Action series batteries and accessories, while Osmo Nano reuses the core sensors of flagship products. From UI interaction between devices to the operational logic of editing software DJI Mimo and DJI Studio, DJI has built a highly unified user and creative experience. Users can operate different devices within the same ecosystem to complete the entire process from shooting to production.

From this, it can be seen that DJI’s product definition capability has evolved from solving pain points in individual scenarios to a universality that transcends scenarios. In a refined space, achieving professional level experience and cross product line collaboration tests its ecological integration ability.

This type of ecological collaboration not only enhances user experience, but also reduces R&D and supply chain costs through economies of scale. With its manufacturing capabilities and supply chain advantages established in fields such as drones, DJI has gradually distanced itself from its peers in key component customization and production efficiency.

Furthermore, the cost advantage has also been transformed into a ‘user dividend’, enabling more people to access innovative technology at a lower threshold. And the widespread user recognition continues to support product iteration and category expansion, forming a positive cycle.

Essentially, ecological collaboration has become a technological lever for DJI to expand its capabilities in depth scenarios, allowing DJI’s product layout to resonate on their respective “battlefields” where they excel. Amplify the advantages of a single product into a protective barrier for the entire brand.

Breaking through the ‘redefinition’ process

After officially entering the field of panoramic cameras, DJI also launched the Osmo 360 with a one inch base, facing the balance problem between size, power consumption, and image quality of traditional panoramic cameras.

From a technical logic perspective, the root cause lies in the widespread use of rectangular CMOS designed for mobile phones in the industry to capture circular image fields, resulting in nearly a quarter of the sensor area being wasted. Before DJI entered the market, this was not an unnoticed issue, but when panoramic cameras were still a niche category, the upstream supply chain lacked the motivation to customize core components for niche categories.

For supply chain manufacturers, if they need to open a separate production line for this, it is best to first ensure stable customers and a demand for large-scale production. In this game located at the back of the market, DJI did not compromise, but chose to push the supply chain further forward by proposing a customized square CMOS solution. This decision fundamentally changed the technological path: square CMOS allows the circular image field to be perfectly inscribed, increases sensor utilization by 25%, and enables native 8K panoramic videos to be produced directly without upsampling. This can fundamentally solve the pain points of users in the traditional panoramic camera industry.

In addition, Osmo360 introduces a 10 bit D-LogM color mode and seamlessly transfers mature image stitching algorithms and intelligent tracking technology from the drone field to handheld devices, effectively solving the pain points of natural stitching and editing efficiency in panoramic videos. While achieving high performance, the product is priced at 2999 yuan to lower the threshold for professional level panoramic creation.

Osmo360

The market performance of Osmo 360 quickly confirms the success of this technological roadmap. Looking back at GoPro, which has a too single product line, it incurred a loss of $432 million in 2024 and will continue to decline in 2025.

However, the ecological expansion of DJI’s technological and aesthetic upgrades, as well as the transfer of capabilities, has not stopped here. The deeper logic lies in the precise capture and definition of new market demands through the integration and innovation of “sky” and “ground” technologies.

After experiencing rapid growth in the consumer drone market, it is facing the dual challenges of experience homogenization and increasingly strict regulatory oversight, while users crave more convenient, secure, and socially shareable creative tools. In this context, combining the immersive recording capability of panoramic cameras with the unique perspective of drones has become an inevitable technological direction.

Along with Osmo 360’s ascent to the top, it is reported that the first panoramic drone Avata 360, which was approved by DJI in 2022, has also been exposed in spy photos by multiple foreign media: this product has a fully wrapped paddle arm design similar to the Avata series accumulated from drone products, and DJI O4 image transmission; At the same time, it is highly likely to reuse the Pisces lens design of the Osmo360 panoramic camera and its accumulated square CMOS solution. This cross dimensional technological reuse may ultimately give rise to a new species that breaks through traditional category boundaries.

Whether it’s sports cameras, panoramic cameras, or spy drones with frequent spy photos, in this era where image recording is inseparable from human creativity and entertainment, the “game rules” of the industry are constantly being reshaped.

The product evolution path of “technology ecological players” represented by DJI has shown systematic and ecological development characteristics. The ‘one hit victory’ of new products and categories is not an accidental victory of a single product, but an inevitable result of DJI’s long-term technological accumulation, precise scene insight, and supply chain integration.

From the beginning, DJI did not treat imaging equipment merely as cold hardware, but rather focused more on the warmth of human nature: shooting is not only technical, but also aesthetic, and at the moment of encountering scenery during a trip, taking out the device at will to reject the speed and convenience of “FOMO travel experience”.

Reviewing DJI’s camera journey can be seen as a continuous rewriting of industry rules. Firstly, the “sky” technology accumulated in the field of drones will be accurately “landed” on the ground and ocean; Then break away from the competition of hardware parameters and shift towards building an ecosystem centered on user experience and supported by technological collaboration. While injecting growth momentum into oneself, it also provides a long-term reference for the industry.

This confirms the core value of a top technology company: it is never satisfied with sailing in the existing waves. Every time we set sail today, our goal is to become the wave maker of tomorrow.

暂无评论内容