Recently, OpenAI was revealed to be working on developing artificial intelligence for generating music. According to technology media The Information, OpenAI is collaborating with students from Juilliard College to annotate music scores.

This news has brought another AI startup that has already formed a data flywheel in AI music generation into the public eye, which is Suno – regarded as the “ChatGPT” of the music industry.

In 2024, Suno made a breakthrough by achieving one-time AI generation of a series of music content such as lyrics, vocals, and accompaniment for the first time.

At the end of October, it was revealed that Suno was about to complete a new round of financing with a total amount of $100 million. After the financing was completed, Suno is expected to be valued at $2 billion, which is four times the previous valuation. Suno has also become one of the fastest-growing artificial intelligence companies.

Tiger Sniff has discussed the Suno project with several AI entrepreneurs and investors. For many musicians, Suno is a disruptive product. Suno’s success once again proves the importance of product taste and data flywheel.

Liu Zhen, founder and CEO of third-party data company Xsignal, stated that every track requires refined operations and involves a lot of vertical know-how experience. For example, professional understanding of composition and grasp of AI music copyright issues. Suno has gone through hardships and accumulated experience and methods to cope with them.

The research team of UpHonest Capital stated that the community atmosphere of Suno is very good, with a bit of an AI version of Spotify, and users naturally have a good impression of the songs they create. Suno will also recommend creators in the community to share their songs.

There are many products generated by AI music, including Udio and Riffusion, but musicians who have used different products say that Suno has the best effect.

We attempt to analyze how Suno creates unique products and operates a user community through dismantling the company, and how it can still gain sustained attention from capital in the competitive environment.

In a blank market, achieve a valuation of $2 billion

The core breakthrough of Suno is that it generates complete songs that include vocals, lyrics, arrangement, and mixing instead of scattered melodies or monotonous beats, lowering the threshold for music creation from “years of professional training” to “just imagination”.

Before the birth of Suno, the focus of generative AI was mainly on the fields of text (such as GPT series) and images. In contrast, the development of “audio AI” is relatively lagging behind, and high-quality audio generation, especially music generation containing complex structures and emotional elements, is an untapped market.

Tiger Sniff once talked to Jiang Tao, the CEO of Yinchao, who was one of the earliest people in China to create music. He said that even now, music generation is still a niche but fun track. In the field of technology in China, there are not many people who do voice and audio generation, and music generation is one of the most niche groups. Domestic experts can count it on one hand. People in this field are not only the ones who understand algorithms the most among music players, but also the ones who understand music the most among algorithm makers.

The emergence of Suno is precisely to fill this market.

As an AI native application company, Suno has grown rapidly, raising a total of $125 million since its establishment in 2022. Its Series B funding in May 2024 was led by Lightspeed Venture Partners, with a post investment valuation of $500 million. The investors also include well-known institutions and angels such as Nat Friedman, Daniel Gross, Matrix Partners, Founder Collective, etc., with deep backgrounds in the fields of AI and technology.

In October 2025, it was reported that Suno was in talks for a new round of $100 million financing, with a valuation expected to soar to $2 billion, four times the previous round’s valuation. This reflects the high optimism of the capital market towards the AI music industry, where investors are still willing to bet on its growth potential even under copyright legal risks.

Since the launch of its first product in the second half of 2023, Suno has experienced astonishing user growth. Within just 8 months of its launch, Spotify has surpassed 10 million users, compared to Spotify which took a full 4 years to reach 10 million users.

As of mid-2024, over 12 million people have tried Suno for music creation. The huge user base brings considerable revenue, and there are even reports that Suno’s current annual recurring revenue (ARR) has exceeded $100 million. The user activity is equally impressive, with an average of 10 new tracks generated on the platform every second.

This growth model is not comparable to traditional software companies, as its valuation has doubled in just five months, and ARR has grown from almost zero to over a billion dollars in less than a year.

National ‘Musicians’

Essentially, Suno is a text to music generation platform based on web and mobile apps. Its core interaction logic is extremely simple: the user inputs a descriptive text prompt, and the AI can generate a complete song within a few seconds.

The term ‘complete’ here refers to a song that not only contains melody and accompaniment, but also includes AI synthesized vocals and generated lyrics, which fundamentally distinguishes Suno from most AI tools on the market that can only generate pure music.

In July 2024, Suno launched its first mobile application (iOS), bringing the above features to mobile phones, making it convenient for users to record inspiration and create music anytime, anywhere. The mobile device also integrates a mobile phone microphone, which can record environmental sounds (such as bird songs, conversations, etc.) and automatically integrate them into the creation, allowing real sound materials to be converted into music elements.

Users can also upload or record a sound (humming, sample melody, rhythm tapping, etc.), and AI will continue to compose songs based on it, and then create melodies based on these sounds. This feature makes it possible to “randomly sample and improvise”.

Suno also provides “Add Accompaniment” and “Add Vocal” tools. After users generate preliminary sections, they can further enable AI to automatically add additional orchestration or harmony vocals.

For example, a clear singing melody can generate a complete accompaniment with just one click; Or add AI sung vocal cords to melodies without lyrics. This enables ordinary users to complete complex arrangements and production processes.

Suno’s model iteration speed is extremely fast, and every major version update brings a qualitative change in experience. From the earliest well-known V3/3.5 version to the latest V5 (Beta) version, Suno’s improvements in sound quality and vocal realism have been rapid.

Especially the latest V5 model, based on feedback from a large number of community users, has achieved a “huge improvement” in sound quality, instrument clarity, and human voice realism, with the naturalness of human voice described as “almost indistinguishable from real people”.

Almost simultaneously with the release of the V5 model, in September 2025, Suno released the desktop application Suno Studio, claiming to be the world’s first “generative audio workstation”.

It integrates multi track editing functions similar to professional digital audio workstations (DAW). Users can separate the various instrument tracks of a song, such as vocals, drums, bass, etc., and independently edit and mix them in Studio, marking a new level of professionalism for Suno.

Suno Studio integrates AI generation into professional multi track workflows to achieve human-machine collaborative composition. Studio provides professional level rhythm BPM control, pitch and volume adjustment, and supports exporting each generated track as an audio or MIDI file for continued production in other software.

Suno Studio greatly expands creative freedom and is seen as an important exploration for the future combination of professional music production and AI.

Suno currently mainly operates through a subscription based value-added model (freemium), and only the highest end Premier can enjoy the latest and most powerful model versions (such as the v5 engine) as well as Suno Studio.

Unlike many music apps that target professional creators, Suno targets the general public with a wide user base. Its co-founder explicitly stated, “What we want to do is create a creative tool for everyone, not just a technology that serves a few professionals

According to the official blog, Suno’s core user group includes the largest and most dynamic mass user group, who use Suno for various purposes, including pure entertainment, creating unique BGMs for social media posts, composing music for family videos, or simply turning their thoughts and emotions into a song to share with friends. For them, Suno is a novel toy and a personal expression tool.

Next are content creators or marketers, including video bloggers, podcasters, independent game developers, and advertising marketers. They have a huge rigid demand for high-quality, copyright free customized music. Suno provides them with an extremely efficient solution that can generate background music or advertising songs that match specific emotions, styles, and themes within minutes, greatly reducing the cost and time of content production.

Although Suno’s goal is popularization, it has also attracted more and more professionals. For this group, Suno mainly plays the role of inspiration generator and music prototype verification.

Even Grammy winning producer Timbaland has publicly stated that he spends up to 10 hours a day using Suno for creative exploration.

Tiger Sniff had previously talked to an AI entrepreneur whose musician friend was using Suno to create songs. He threw a set of prompts and lyrics to ChatGPT, which deconstructed the music elements and translated them into Mongolian, allowing Suno to generate a Mongolian song.

A group of musicians from financial companies

Behind any phenomenal company, there is always a unique founding team, and Suno’s story is no exception.

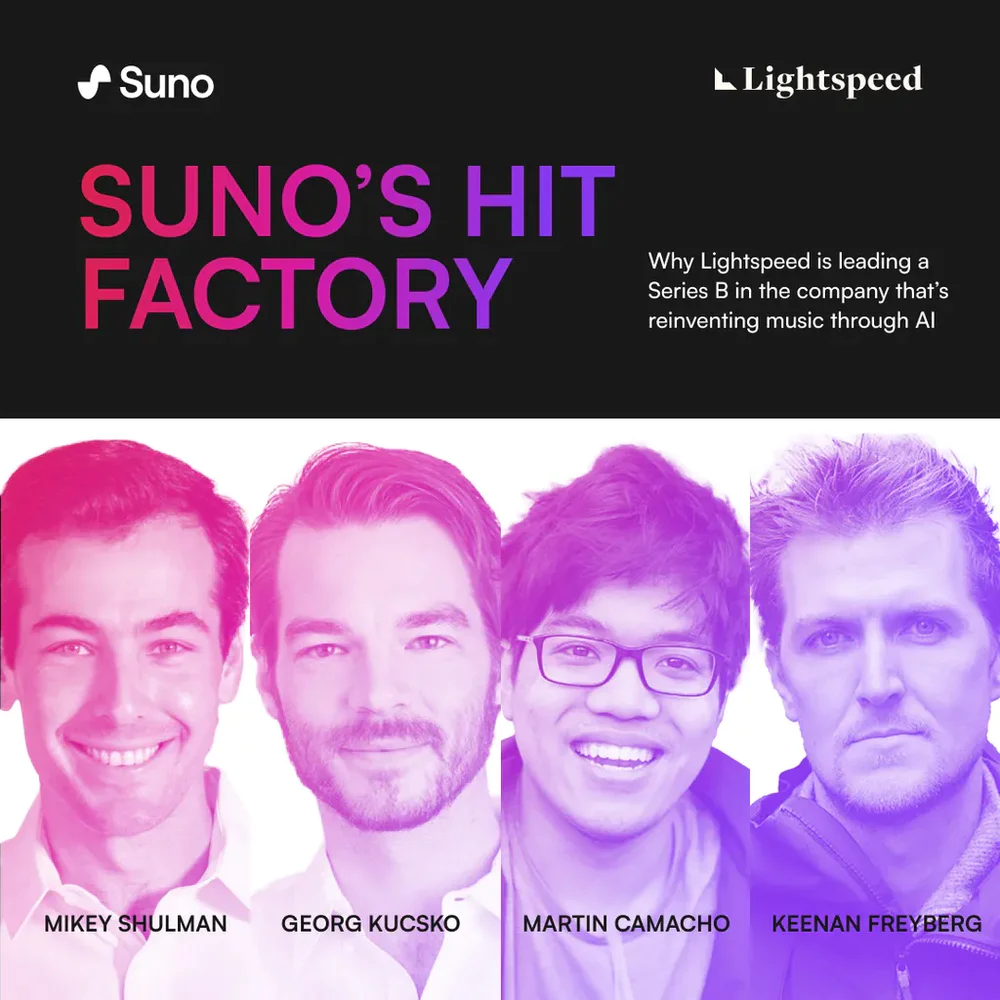

Suno was founded in Cambridge, USA in 2022 by four co founders who are both passionate about music and proficient in technology. The four founders are Mikey Shulman (CEO), Georg Kucsko, Martin Camacho, and Keenan Freyberg, who worked together at Kensho, a financial AI company in Cambridge and met each other through their work.

Many members of the team have a high degree in physics or computer science from Harvard University, among whom CEO Mikey Shulman holds a PhD from Harvard University. During their collaboration at Kensho, they discovered that they both had an amateur passion for music creation, almost making them a combination of “lifelong musicians+tech geeks”.

CEO Mikey Shulman has long played in bands, recorded and performed in New York, and has a deep understanding of the hardships that ordinary people face in creating music. Although he himself is quite skilled in technology, he still feels that the threshold for music creation is extremely high: not only does it require training or musical talent, but it also requires investing a lot of time and money.

Moreover, at Kensho, one of the core tasks of the team is to process audio data in the financial field, such as recordings of financial conference calls filled with accents, background noise, and professional jargon. This work made them deeply realize how backward and immature the level of audio AI technology was compared to text and image AI at that time.

According to team members in interviews and community sharing, they often “abuse” this internal tool late at night to “play music” when developing an audio big language model for processing financial recordings.

They gradually realized that AI can perform improvisation and can be used for creativity full of infinite possibilities.

With this starting point in mind, the four founders left their original company directly at the end of 2022 and invested in the establishment of Suno. They received seed funding support from venture capitalists such as Matrix Partners in the early stages and completed a Series A financing (amount undisclosed) in March 2023 to develop core technology.

At the beginning of founding Suno, the team’s first public project was an open-source text to audio model called Bark, which was released in 2023. Bark can generate very natural speech, sound effects, and even singing voices, and quickly became popular in developer communities such as GitHub, receiving thousands of stars.

In the interaction with the community, the team received a lot of feedback, and one voice became increasingly strong and clear: “This tool is cool, but we really want to use it to make music, not just talk.

It was this direct and strong demand from users that ultimately ignited the team, causing them to shift the company’s strategic focus from a universal audio tool to Suno, which focuses on music generation.

The Suno founding team showed a bold side in the early stages of the product. They are well aware that training such AI models inevitably involves copyrighted music data, which may lead to dissatisfaction and even litigation in the traditional music industry. However, early investors such as Antonio Rodriguez, a partner at Matrix, expressed understanding of the founder’s choice, stating that “this is a risk that we must bear when investing”.

Rodriguez even bluntly stated, ‘If the company had approached a record company for licensing at the beginning of its entrepreneurship, I wouldn’t have invested. They need to create their products in an unconstrained environment.’. Under this endorsement, the Suno team chose to focus on polishing their products, expanding their user base, and gradually addressing copyright compliance challenges.

The increasingly intense music generation track

The market in which AI generated music operates is experiencing explosive growth.

On the one hand, the global digital music industry is vast and continues to expand, with the music streaming market generating over 26 billion US dollars in 2023. On the other hand, AI music creation, as an emerging niche field, has a steep growth curve in the past two years: according to platforms such as French streaming service Deezer, music generated entirely by AI now accounts for 28% of daily uploaded tracks, and this proportion is still rapidly increasing.

Deezer reports that its daily AI original tracks have skyrocketed from 10000 in early 2023 to 30000 per day in October of that year. It can be foreseen that AI will contribute a considerable share of global music works in the future. Suno’s current user base of over 10 million and output rate of 10 tracks per second to some extent validate this growth myth.

It is worth noting that the traditional music technology field has experienced a downturn in the past few years: from 2010 to 2018, there were a large number of top financing cases (mostly for streaming platforms and music hardware), but since then, due to factors such as slowing growth in the streaming market and high copyright fees, investment has tended to calm down.

Suno received an unprecedented large amount of financing in 2024, becoming one of the few music technology startups that has caused a sensation since 2018, and is seen as a symbol of the industry entering a new round of innovation cycle. The recovery of capital indicates that the music industry is shifting from the “channel is king” streaming media red ocean to seeking breakthroughs in blue ocean fields such as creative empowerment.

The best proof is that in October, Universal Music Group CEO Lucian Grainge reiterated in an employee memo that the company is willing to collaborate with AI companies to develop products, provided they respect copyright.

There are two pain points in the music industry for a long time: firstly, the threshold for creativity is high, and professional musicians are still a minority. The music creativity of a large number of ordinary people has not been stimulated; Secondly, the mismatch between supply and demand on the content side is limited by the speed of human creativity, making it difficult for the music market to provide customized content for massive personalized and long tail demands. The emergence of generative AI music is exactly the right remedy.

In terms of competitive landscape, current AI music creation is still in its early stages and can be seen as a “blue ocean market” overall, but it is rapidly becoming popular. At present, the giants in the mainstream music industry (such as record companies and streaming media) are closely monitoring but have not yet taken the lead in this field, giving start-up companies the opportunity to take the lead.

Tech giants have taken action one after another, but overall they are not yet mature. Google showcased its music generation model MusicLM as early as 2023 and opened a limited trial version at the end of the same year; Meta’s AI research team has launched an open-source text generated music model (such as MusicGen, part of the AudioCraft project) for developers to try out. OpenAI, as a leader in generative AI, has not yet officially released a music product, but reportedly is developing an AI music platform internally.

This situation also occurs in China. As a C-end traffic entry point, music is definitely a field that tech giants will enter. However, Tiger Sniff has talked to entrepreneurs who generate AI music, and the determination of big companies to enter and the depth of their efforts are not as strong as start-up companies. The entrepreneur said that taking ByteDance as an example, their music generation belongs to the algorithm platform, which is a non-profit department. However, in large companies, their products are mainly production tools. This is a very contradictory state, “he said.

But Suno’s competitors are not only big companies, but also start-up companies that are more dangerous. With the lowering of the threshold for AI technology and the emergence of business prospects, various players are flocking in, and startups are beginning to enter the market.

Udio, an AI music platform from the United States, is known as the industry leader alongside Suno. Udio focuses on enabling users to generate personalized songs, and similar to Suno, it also faces copyright litigation challenges. Udio received $10 million in financing in early 2024, which is not as much as Suno, but still attracts attention. Its biggest feature is its emphasis on collaborating with independent musicians, with investors and consultants including music industry professionals such as singer will.i.am, who have slightly different industry resources.

Earlier AI music platform Boomy allowed users to generate background music through simple option combinations and claimed to have created millions of songs. In 2023, Spotify temporarily removed a large amount of music uploaded by Boomy users due to suspected issues such as “traffic cheating”. Boomy received a $5 million investment in 2021 and was one of the well-known players in the field before Suno’s emergence.

Beatoven, an AI music startup from India, specializes in royalty free music generation. Users can choose their mood and style, and AI generates background music for videos and games. Beatoven is more like a B2B tool, providing low-cost music solutions for content creators. Although the segmented fields are different, they are similar in technical principles and have potential competitive relationships with Suno.

In addition, AI music companies with different positioning such as Splash, Bronze, AIVA, Soundful, etc. have emerged. For example, Splash integrates AI music into electronic games; Bronze focuses on AI interactive music experience, attracting investment from some artists; AIVA was an early provider of AI music services, which have been used for short films, advertisements, and more.

Another risk besides competition is copyright.

Suno is the most typical, facing a joint lawsuit from the world’s three major record companies, Sony Music, Universal Music Group, and Warner Music Group. The core allegation of the lawsuit is that Suno used music recordings protected by its copyright on a large scale without authorization to train its AI model.

The accusations made by the record companies are very specific. If we consider the size of the music libraries owned by the three major record companies, these lawsuits could instantly bankrupt any startup company, including Suno, in place.

This is also a common problem faced by AI music generation companies today. Tiger Sniff has communicated with AI music entrepreneurs before, and for them, there is currently no global reference for this matter. If they consider copyright in the first place when doing this, it will restrict their hands and feet. The practice of some AI music generation companies is to obtain some copyright authorization and extract some elements without copyright.

There is an interesting twist in Suno’s situation, despite the heated lawsuit, multiple media outlets have reported that Suno is negotiating licensing agreements with record companies including Universal and Warner.

According to reports, the negotiation content not only includes future licensing fees, but may even involve allowing record companies to invest in Suno through equity investment. This incident is even considered a betrayal of traditional music companies to AI companies.

This dramatic scene may foreshadow a new fusion between the “wild growth” of AI native application company Suno and the existing rules of the traditional music industry in a fierce collision.

Look, Suno is helping us find a way out. ”An AI music generation entrepreneur said.

暂无评论内容