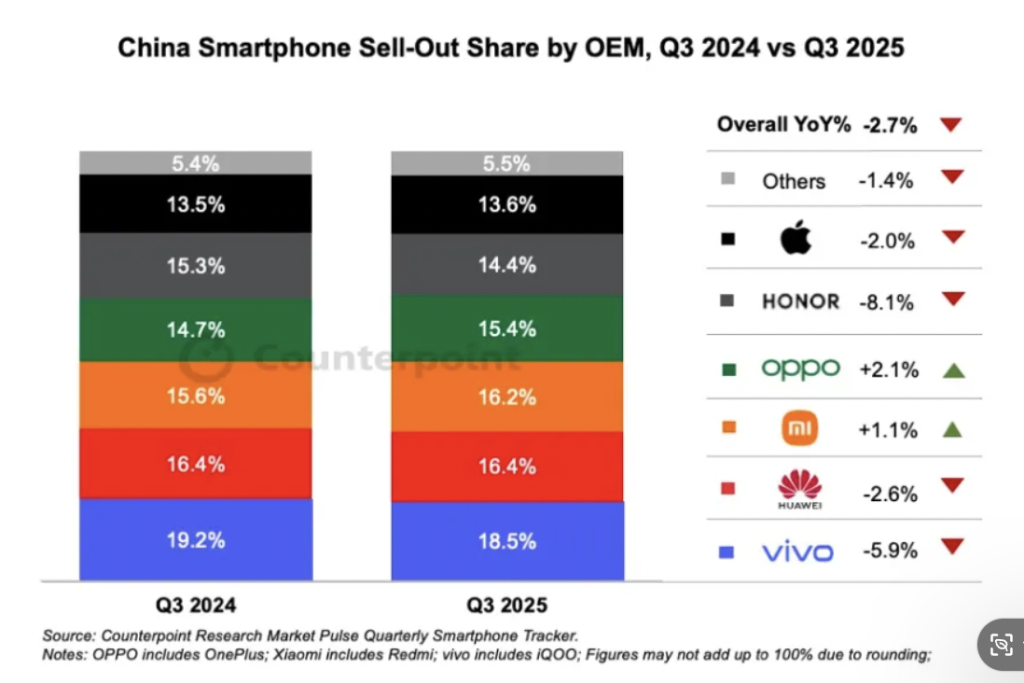

On November 6th, market research firm Counterpoint released data on China’s smartphone sales for the third quarter of 2025, showing that the overall sales of the domestic smartphone market decreased by 2.7% year-on-year. The agency believes that consumer demand remains sluggish due to the impact of summer vacation and the start of school season. Although the impact of the national subsidy policy has weakened after the first quarter, the policy continues to support the average selling price (ASP) of Chinese smartphones.

Among major mainstream mobile phone manufacturers, vivo ranks first with a market share of 18.5%, but its sales have decreased by 5.9% year-on-year; Honor became the brand with the largest decline in sales, with its market share dropping to 14.4%, ranking fifth.

Despite the overall downward trend in the market, vivo has successfully maintained its leading position by performing well in different price ranges. Among them, models such as S30 and X200s have attracted a large number of consumers in the mid to high end market. The newly launched entry-level products such as Y500 and Y300 have further consolidated the brand’s market position with their high cost-effectiveness advantages.

The market share and sales of mainstream manufacturers in the Chinese mobile phone market in the third quarter. Image source

Huawei continued to make efforts in this quarter, although the sales of high-end models Mate 70 and Pura 80 series were slightly lower than their predecessors, the Nova 14 series maintained a good sales trend relying on performance and affordable prices, helping Huawei stabilize its market share.

However, as the new models are still in the stage of improvement with the HarmonyOS NEXT operating system, the number of applications and adaptability still need to be improved, which to some extent affects consumers’ purchasing decisions. In the third quarter, Huawei’s market share remained the same as the same period last year, at 16.4%, with a sales decline of 2.6%.

OPPO showed clear signs of recovery in the third quarter, with the Reno 14 series showing a stable growth trend and its subsidiary OnePlus performing outstandingly, driving OPPO to achieve a year-on-year growth of 2.1% in the overall market, ranking first among major manufacturers in terms of growth rate.

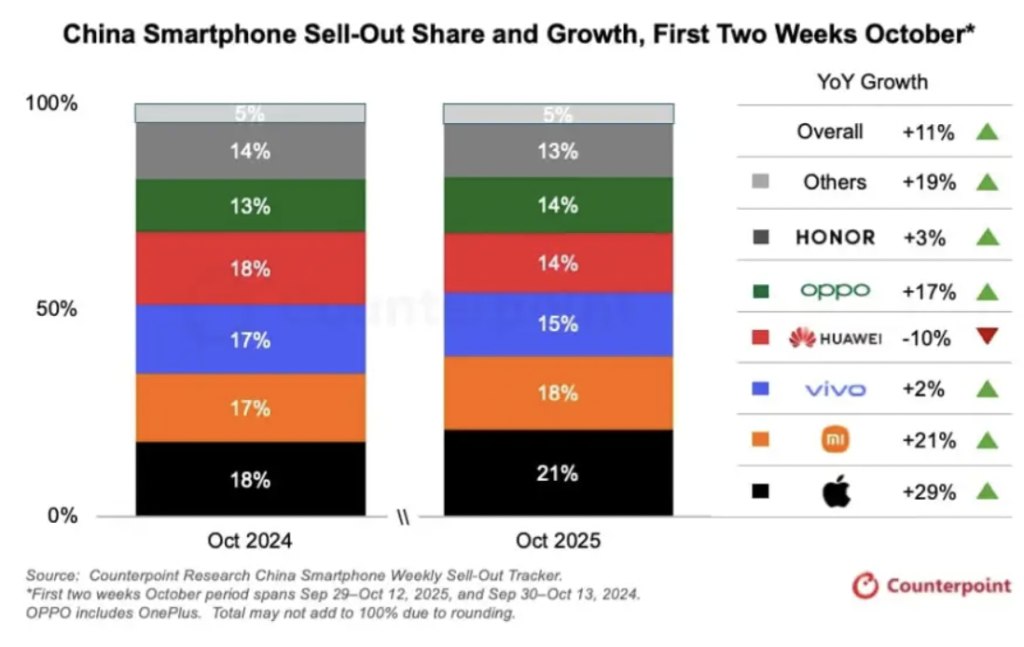

With the help of the REDMI Note 15 and K80 series, Xiaomi’s sales in this quarter increased by 1.1% year-on-year, making it another brand among the six major manufacturers to achieve positive growth, except for OPPO. The recently released Xiaomi 17 series has been highly sought after in the market since its launch, thanks to its imaging system, high-performance processor, and fast charging technology. Especially the two high-end models, Xiaomi 17 Pro and 17 Pro Max, have further enhanced the brand’s influence in the high-end market, making Xiaomi the second fastest growing mainstream smartphone brand after Apple in early October.

In contrast, Honor’s performance in the third quarter was not optimistic, with sales declining by 8.1%, making it the brand with the largest decline among major manufacturers. Although the Honor X70 series has achieved some success in the entry-level market with its large capacity battery, fast charging function, and durability, the overall brand still faces challenges.

Analysis suggests that Honor’s problems in product innovation, brand positioning, and channel construction have gradually become prominent, leading to its lagging behind in fierce market competition. In addition, Honor is attempting to transform into an AI device ecosystem company, and related investments have not yet been translated into significant market competitiveness.

In terms of international brands, Apple’s market share is 13.6%, with a slight increase, but sales have declined by 2%. Despite the slowdown in sales of older iPhones, the outstanding performance of the iPhone 17 series has enabled Apple to maintain strong competitiveness in the high-end market.

Counterpoint senior analyst Mengmeng Zhang pointed out that Apple’s pricing strategy has put tremendous pressure on other high-end Android brands, and with more flagship models about to be released, it is expected that market competition will become more intense in the fourth quarter.

Market share and sales of Chinese smartphones in the first two weeks of October

Despite the overall sluggish market in the third quarter, the overall sales of smartphones in China increased by 11% year-on-year in the first two weeks of October, indicating a good start to the fourth quarter. As major manufacturers increase their efforts to release new products at the end of the year, market competition will become increasingly fierce, and there are still many variables in the future landscape of domestic mobile phone brands.

暂无评论内容