Losing 250 billion yuan in blood, he made another move

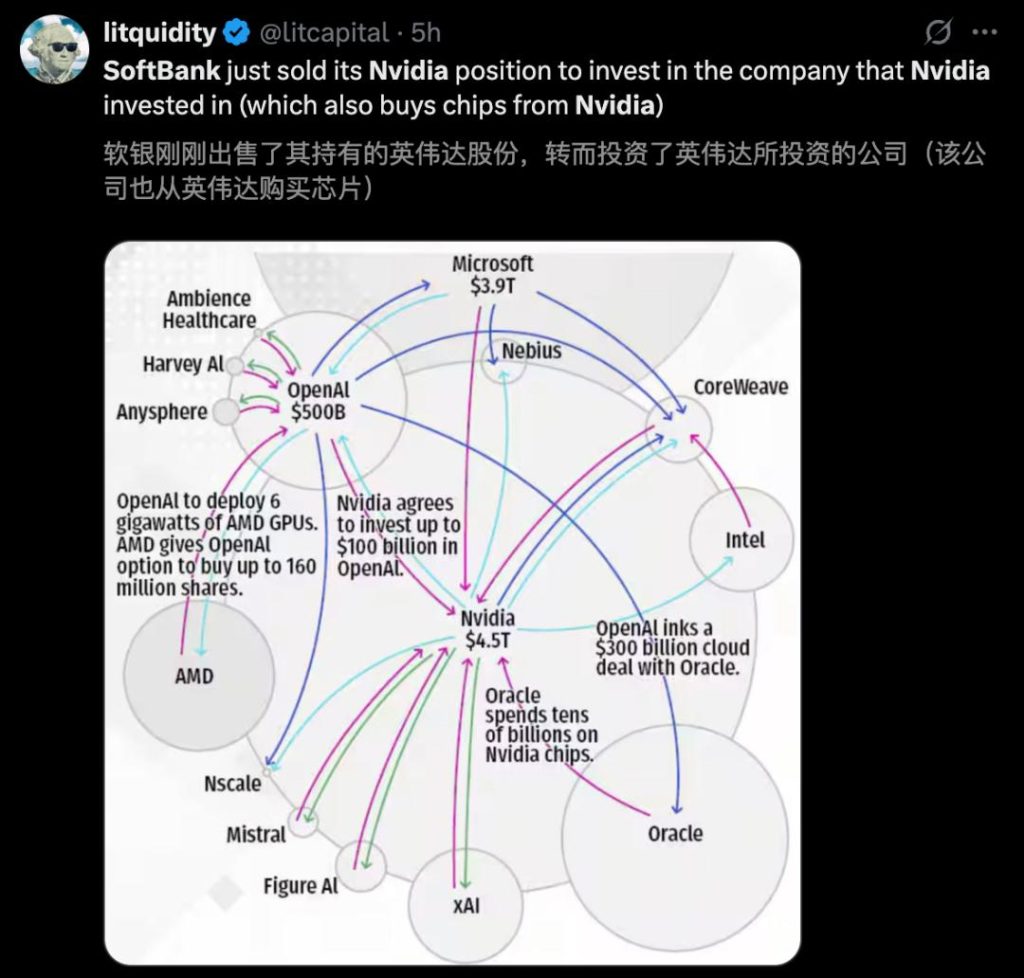

Son Masayoshi, who once missed out on $250 billion on Nvidia, is now voting with his feet again. He is betting that the future of AI lies not in Nvidia, which manufactures shovels, but in OpenAI, which defines gold mines.

In order to invest in OpenAI, SoftBank cleared its position in Nvidia.

Just yesterday, Japanese tech giant SoftBank sold all of its shares in Nvidia, totaling 32.1 million shares, for $5.83 billion.

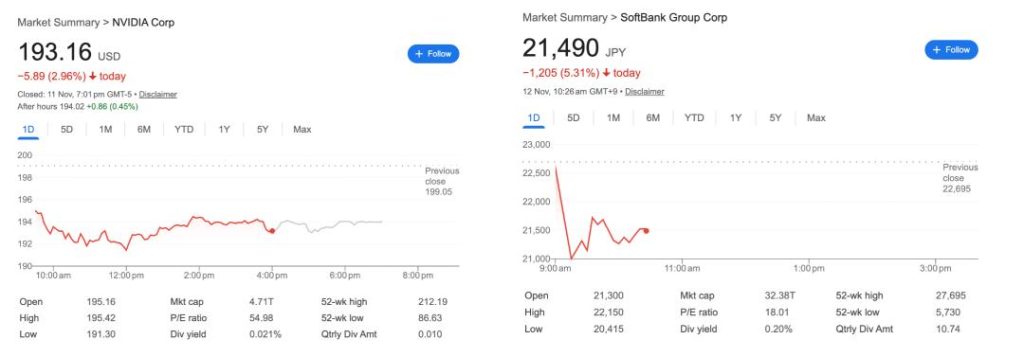

On that day, Nvidia’s stock price fell nearly 3% and SoftBank’s stock price fell more than 5%.

At the same time, SoftBank also sold a portion of T-Mobile’s shares worth $9.17 billion.

Sun Zhengyi cashed out so much mainly to make up for subsequent investments, including promising to build OpenAI’s “Stargate”.

Part of the funds will also be used for the $6.5 billion acquisition of Ampere and the $5.4 billion robotics project in collaboration with ABB.

Withdraw from Nvidia and invest in OpenAI

SoftBank was once the largest shareholder of Nvidia.

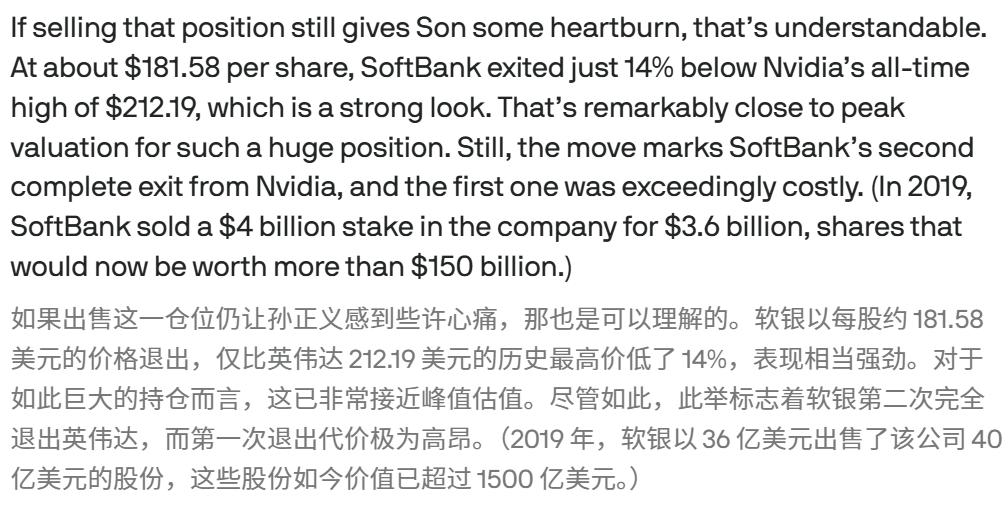

In 2019, Masayoshi Son liquidated nearly 5% of his shares. According to TechCrunch, he bought $4 billion at the time but only sold for $3.6 billion.

But afterwards, the AI wave swept the world, and Nvidia’s stock price soared to $5 trillion at one point.

According to foreign media calculations, if SoftBank had not sold off these shares too early, it would not have missed out on a huge wealth of $250 billion.

At the NVIDIA AI Summit held in Tokyo in November 2024, a humorous interaction between Huang and Masayoshi Son on stage became a famous scene.

Lao Huang joked, ‘You may not know that Sun Zhengyi was once the largest shareholder of Nvidia.’.

As soon as these words were spoken, Sun Zhengyi put his hands on Lao Huang’s shoulders and made a gesture of “regret and tears”. Lao Huang also laughed and responded, ‘Let’s cry together.’.

Since clearing its position in 2019, SoftBank has “returned to the pot” by buying some shares of Nvidia, and has continuously increased its holdings in the fourth quarter of 2024 and the first quarter of 2025.

SoftBank disclosed that as of the end of March, its investment in Nvidia was approximately $3 billion.

Until October this year, SoftBank had accumulated a total of 32.1 million shares and sold all of them to cash out $5.83 billion.

On that day, Nvidia’s stock price fell by over 2%, which also dragged down the S&P 500 index. The outside world once thought that the prediction of “AI foam” had really been fulfilled.

At the financial report and briefing, SoftBank gave very direct reasons——

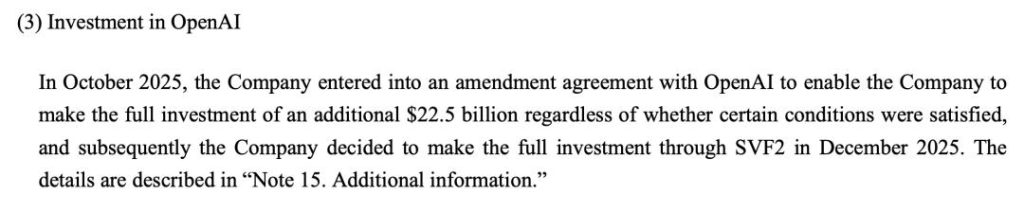

To raise funds for a larger AI layout, including a massive commitment of $40 billion to OpenAI and participation in the $500 billion Stargate project for larger computing power and data centers.

Especially in recent weeks, the sound of AI foam is getting louder and louder. Some investors believe that the valuation of the AI industry may have deviated from fundamentals.

In addition, CoreWeave lowered its revenue expectations due to contract delays, causing its stock price to plummet by 9%, further exacerbating market tension.

CFO Yoshimitsu Goto said at the meeting that I cannot say whether it is in the stage of AI foam at present. The sale of NVIDIA shares is “to make funds better used for financing”, but did not further explain.

Fully bet on AI and expand the ‘arsenal’

In addition to Nvidia, SoftBank also sold approximately $9.2 billion worth of T-Mobile stock.

The withdrawal of this huge amount of funds has once again filled Son Masayoshi’s’ ammunition depot ‘, with the goal of targeting AI applications and the massive infrastructure behind them.

This includes, OpenAI、 Oracle Bone Script and the Stargate project.

This Japanese giant, once labeled as a high-risk player due to its “Vision Fund,” is now achieving a stunning turnaround with AI.

Since the beginning of this year, SoftBank’s stock price has more than doubled. Last month, OpenAI announced a complete departure from its non-profit structure, causing SoftBank’s stock price to soar once again.

In March, SoftBank agreed to lead a round of up to $40 billion in funding for OpenAI, with a valuation of $300 billion.

In October, SoftBank was one of the investor consortia that acquired $6.6 billion worth of shares from OpenAI employees at a higher valuation of $500 billion.

The market’s valuation of SoftBank has increasingly relied on its deep binding with OpenAI. Since SoftBank’s investment, OpenAI’s valuation has risen by $14.6 billion.

Previously, Reuters exclusively reported that OpenAI is considering an IPO with a valuation of $1 trillion as early as next year.

This means that not only SoftBank, but also early investors such as Microsoft, may experience astronomical returns.

But what is even more remarkable is that the $1.4 trillion AI infrastructure blueprint behind OpenAI has not yet disclosed the details of its fundraising.

Investor Ashley Schulman commented that the volatile past of Vision Fund makes this asset sale more like a high-risk game.

Deploying physics AI, investing 5.4 billion yuan

In addition to the response of betting on OpenAI and AI foam, BI also mentioned another key point of AI competition in the Softbank financial report meeting in a report.

Like Nvidia, SoftBank believes that ‘Physical AI’ is the next wave of the artificial intelligence revolution.

It is AI that directly enters the physical field from the digital world. In reality, robot technology and autonomous vehicle are typical representatives.

CFO Yoshimitsu Goto stated that the integration of these technologies will provide more services for the real world and be closer to human life.

Therefore, in October this year, SoftBank acquired ABB’s robotics division in Switzerland for $5.4 billion.

The transaction is expected to be completed from mid-2026 to the end of the year.

At the same time, it also holds shares in the British autonomous vehicle start-up Wave and the service robot company Bear Robotics.

Within SoftBank, a new department called ‘Robo HD’ has been created, consolidating all robot related businesses under one department.

At the same time, the company also pledged to invest $575 million in Robo HD robot investment and development.

In addition, SoftBank plans to acquire Ampere Computing, a US chip design company, for $6.5 billion.

reference material:

https://www.tomshardware.com/tech-industry/softbank-exits-nvidia-with-5-83-billion-sale

https://futurism.com/future-society/nvidia-stock-softbank-ai

https://www.nytimes.com/2025/11/11/business/dealbook/softbank-nvidia-divest.html

暂无评论内容