Last year, Huang Renxun even made a big face on his face

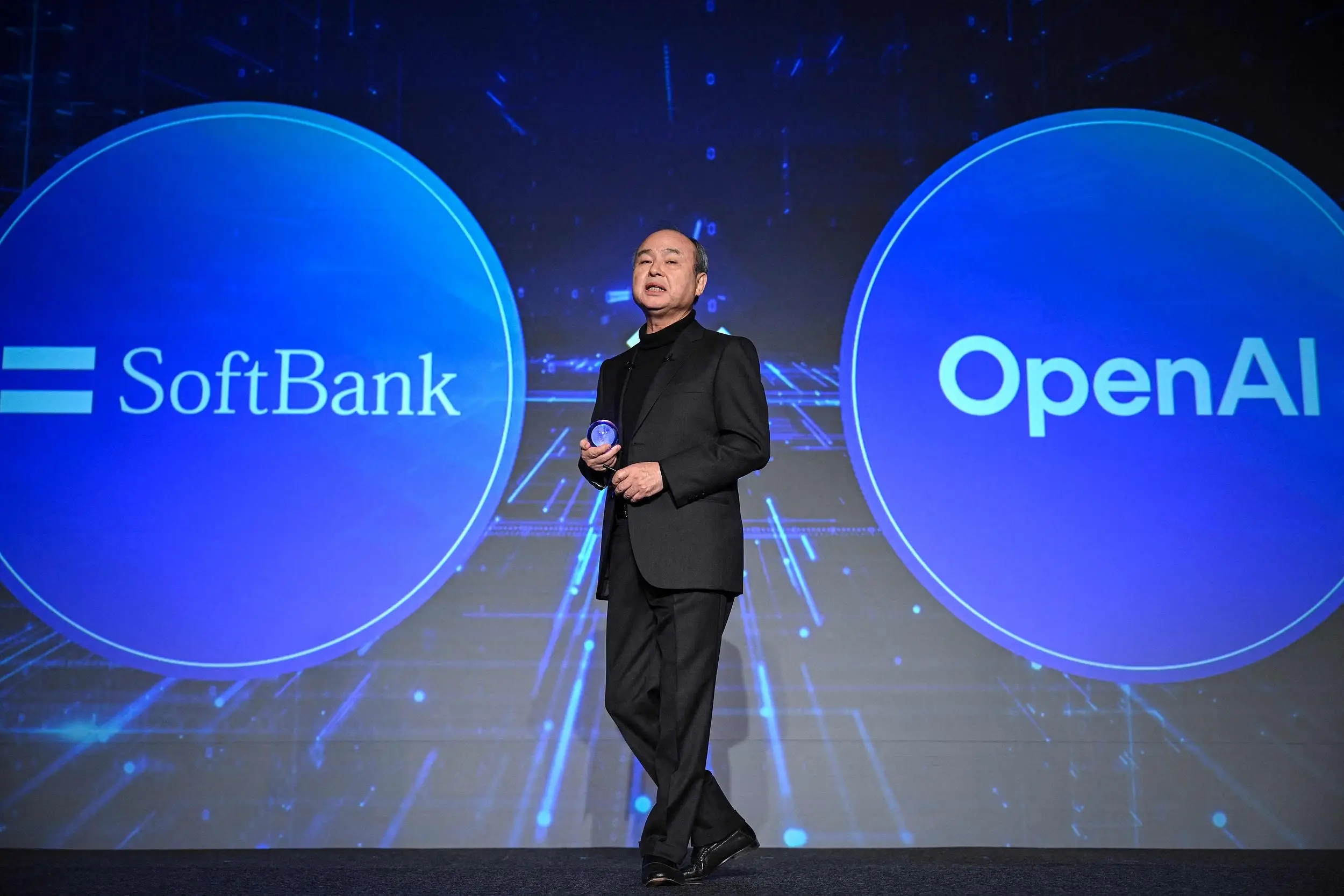

Sun Zhengyi is once again incomprehensible.

At this point in time, he cleared his position in Nvidia, yes, it was a clearance.

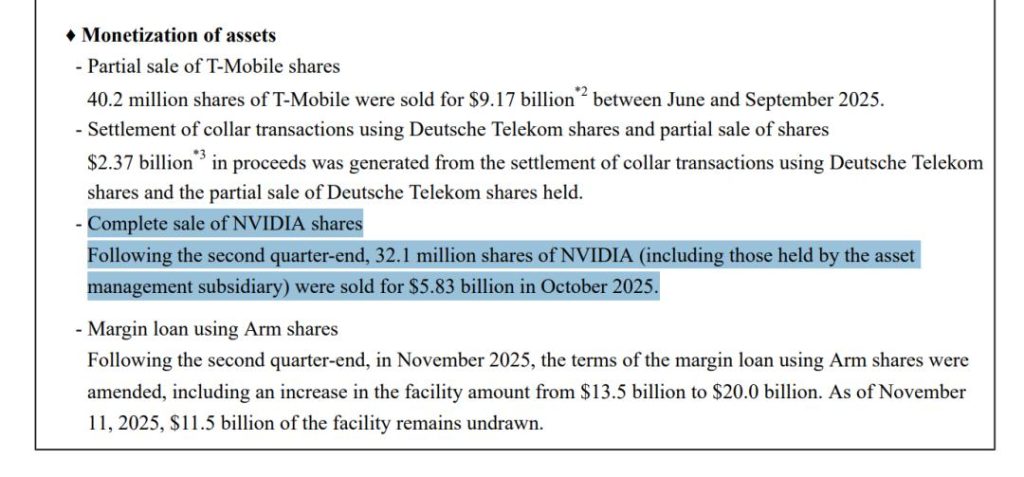

With the release of SoftBank’s second quarter financial report, the report clearly mentioned——

After the end of the second quarter, 32.1 million shares of NVIDIA (including shares held by its asset management subsidiary) were sold in October 2025, cashing out $5.83 billion (currently approximately RMB 41.5 billion).

Wow, you should know that Nvidia’s market value has just surpassed the historic “$5 trillion” mark, and its potential and value are estimated to be clear to everyone.

Moreover, even if you say that Sun Zhengyi seized the opportunity to sell at a high price, in the era of AI, the star company that is regarded as the “core of AI infrastructure” and “hard currency of computing power” still raises questions about clearance——

Did Sun Zhengyi see the AI foam?

After all, the last time he reduced his holdings in Nvidia, he was later mocked by Lao Huang for losing $250 billion in investment returns.

What is Sun Zhengyi thinking?

Son Masayoshi bids farewell to his old love NVIDIA, all in new love OpenAI

To understand what Sun Zhengyi is really thinking, let’s first answer a simple question:

Where will the money cashed out by SoftBank ultimately go? The answer is actually clear – OpenAI.

According to Yoshimitsu Goto, Chief Financial Officer of SoftBank, during the financial report briefing, the clearance move is related to the cooperation between the company and OpenAI.

Due to the large investment scale in OpenAI, funds were raised and utilized through the sale of stocks.

Specifically, SoftBank has signed an agreement with OpenAI, promising to invest up to $40 billion in the latter, with an expected actual investment of $30 billion (excluding $10 billion distributed to co investors).

The first $10 billion delivery was completed in April this year, of which $2.5 billion was borne by co investors and $7.5 billion was contributed by SoftBank Vision Fund Phase II (SVF2). As OpenAI completes its restructuring, SoftBank plans to continue investing $22.5 billion through SVF2.

And part of this money was obtained from the sale of Nvidia stocks.

At the same time, if combined with SoftBank’s financial report and professional market analysis, the timing of “Masayoshi Son’s liquidation of Nvidia” is also very delicate.

The industry generally believes that this may indicate that Masayoshi Son is readjusting his AI strategy. Morgan Stanley analysts said:

Sun Zhengyi’s clearance of Nvidia is not about escaping AI, but about changing seats. The AI train is still running, but he wants to sit in the cockpit.

As for what to replace it with, the answer is hidden in SoftBank’s latest financial report. It is mentioned that SoftBank’s upcoming major investments include:

The follow-up investment in OpenAI is planned to be made in December 2025.

The $6.5 billion acquisition of Ampere, a US fabless semiconductor company, is planned to be completed by the end of 2025.

The acquisition of ABB’s robotics business for $5.4 billion is planned to be completed in the mid to late period of 2026.

The investment in the Stargate project has clearly secured a total of $500 billion/10 GW commitment path.

It is evident that people believe that Masayoshi Son has shifted his investment focus from hardware to the application interaction layer.

Nvidia has always been a public representative of the flourishing development of AI hardware, but SoftBank believes that the greater opportunities lie at the software and model levels.

In simpler terms, Nvidia is responsible for manufacturing shovels, OpenAI is responsible for operating the mine, and Masayoshi Son wants to own this mine.

And another thing worth noting is that OpenAI is likely to go public soon.

The reason why SoftBank approved the remaining $22.5 billion investment in OpenAI was that OpenAI had to complete its restructuring before the end of the year to pave the way for listing.

And at the end of last month, OpenAI did complete its capital restructuring, which also means that its IPO is just around the corner.

Once OpenAI goes public smoothly, Sun Zhengyi’s investment will undoubtedly yield returns from multiple aspects.

And it is worth mentioning that this is not the first time Son Masayoshi has cleared his position in Nvidia.

In 2017, SoftBank purchased nearly 5% of Nvidia’s shares for $4 billion, becoming one of its major shareholders.

But only in 2019, it chose to cash out $3.6 billion to clear all its holdings, and at that time, Nvidia’s market value was also continuously soaring.

(Note: The first liquidation was relatively easy to understand. At that time, SoftBank was facing huge financial pressure from a series of investment failures such as the failure of WeWork’s IPO, so the sell-off was also to stabilize its own financial situation and appease investors.). )

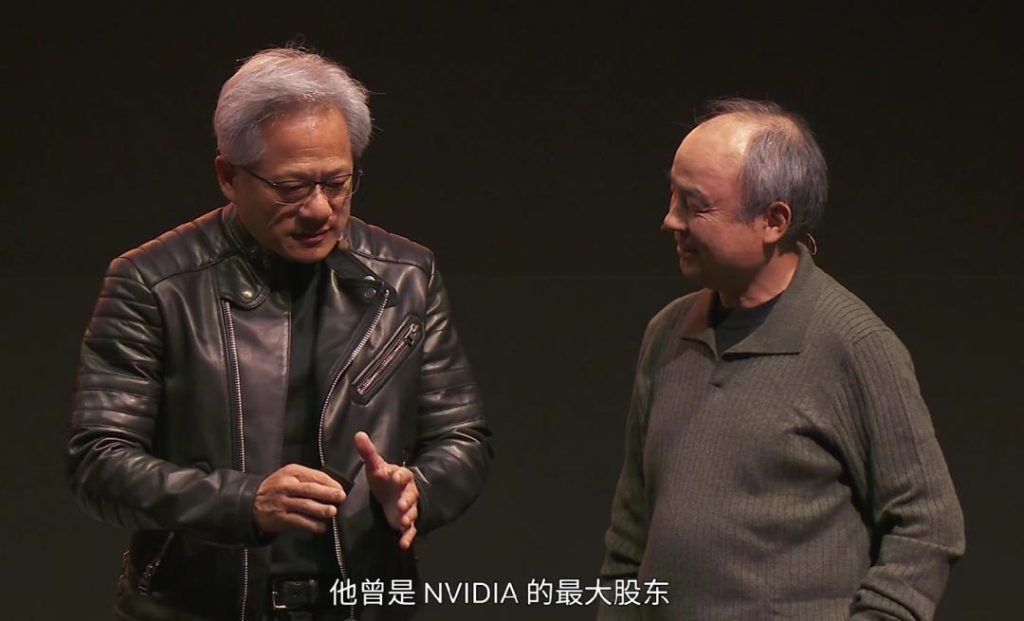

It was not until last year that SoftBank began to repurchase Nvidia. And its first clearance was also openly discussed by Nvidia CEO Huang Renxun.

At the NVIDIA AI Summit held in Tokyo at that time, Lao Huang took the initiative to plead that SoftBank was once a major shareholder of NVIDIA, but later… made a mistake of billions.

Sun Zhengyi, on the other hand, was very embarrassed and started crying with Lao Huang on stage. In a previous interview, he expressed his regret for selling off Nvidia stocks.

According to calculations, the stocks that Sun Zhengyi cleared with 3.6 billion US dollars in 2019 would be approximately 250 billion US dollars now… Yes, 250 billion US dollars!

So I really don’t know if years from now, he will regret clearing his position at Nvidia when AI was at its peak?

This is very Sun Zhengyi

Although the outcome is unpredictable, it must be said that Masayoshi Son’s bold move to liquidate Nvidia and instead bet on OpenAI is indeed in line with his personal style.

Throughout his investment career, high risk, high return, and big spending have always been his most distinctive labels.

For example, the most familiar “successful bet” Alibaba.

In 2000, during the foam of the Internet, Sun Zhengyi made an investment of $20 million in Alibaba, which was said to have been made only six minutes after meeting with Ma Yun. By 2020, this investment will ultimately be worth $150 billion, with a high return rate that will make Son Masayoshi “famous in the first battle”.

And later on, he boldly invested in star companies such as Uber and WeWork on a global scale. Although there are painful lessons like WeWork, they all conform to his radical style of daring to invest heavily in the forefront of the times.

But Sun Zhengyi never had a moment again. Can he invest in another Jack Ma and replicate the Alibaba miracle.

Sun Zhengyi also attributes everything to ‘luck’.

I don’t know if it’s self deprecation or if it’s really the truth

This time, it will be Sam Ultraman and OpenAI who will test his vision.

Reference link:

[1] https://techcrunch.com/2025/11/11/softbanks-nvidia-sale-rattles-market-raises-questions/

[3] https://www.nvidia.cn/events/ai-summit-japan/fireside-chat/

暂无评论内容