At least $7 billion per year, pushing up to 15 billion fraudulent ads to users every day – this is actually the amazing “way to make money” of social giant Meta!

Recently, a “shocking secret” revealed by foreign media directly pointed out that behind Meta’s shiny revenue data, there is a huge black hole: fraudulent advertising business.

Internal documents show that Meta predicted at the end of last year that approximately 10.1% of its annual total revenue, or around $16 billion, would come from high-risk fraud and prohibited product advertisements. Although a Meta spokesperson claimed that the actual number was “lower,” another internal document pointed out that Meta earns approximately $7 billion in annual revenue from only some fraudulent advertisements. Even more shocking is that the company displays an average of about 15 billion “high-risk” scam ads with obvious fraudulent features to users every day.

Moreover, Meta’s approach to dealing with suspected illegal marketers can be described as “black humor”: either forcing them to pay high enough advertising fees, or waiting to be included in an internal “fraudster” report. This mechanism of collecting “protection fees” has turned Facebook, Instagram, and WhatsApp into a stronghold for false advertising. Meta’s internal report even acknowledges an awkward reality: ‘It’s easier to promote fraud on the Meta platform than on Google.’. ”

A Meta spokesperson stated that the company has made sufficient efforts and emphasized that it has reduced the number of fraudulent advertisements reported by users by 58%. However, internal documents revealed that Meta had overlooked or erroneously rejected up to 96% of effective user reports for classifying fraudulent advertisements as a “low severity” issue.

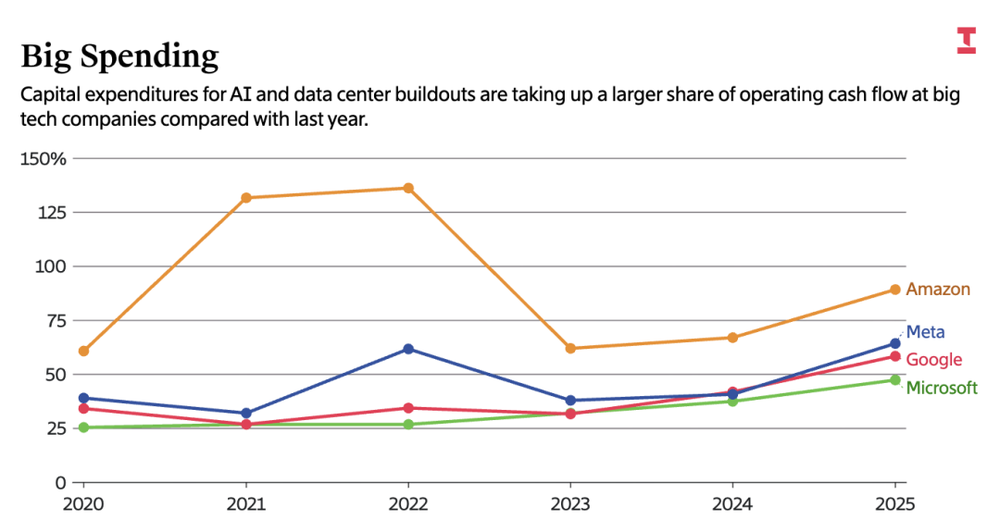

In sharp contrast to the unlimited pursuit of fraudulent advertising revenue, Meta is investing sky high capital into the AI field without limit. The capital expenditure guidance for its AI infrastructure has risen to an astonishing $66 billion to $72 billion.

Meanwhile, Meta is also facing the dilemma of core talents leaving together. After joining Meta in 2013, Yang Likun, known as the “father of convolutional neural networks,” established the FAIR laboratory and promoted it to become a top AI research institution worldwide. However, today he also announced that he is leaving Meta to start his own business. Some media speculate that one of the reasons for Yang Likun’s resignation is that Yang Likun, who originally reported directly to the Chief Product Officer, now needs to report to Alexander Wang, the 28 year old founder of ScaleAI.

According to incomplete statistics, at least 14 people, including basic AI research scientist Chen Xinlei and research scientist Zhuang Jingyao, have switched jobs to Musk’s xAI company, in addition to Yang Likun. In addition, at least 8 employees of the new laboratory FAIR have resigned, and some have returned to OpenAI or joined other companies.

On one hand, there are billions of dollars in “fraudulent revenue” hidden in dirt, and on the other hand, there are billions of dollars in AI infrastructure investment. How does Meta translate the capabilities gained from its AI infrastructure into actual revenue for its business, in order to hedge against the sky high infrastructure costs? And the deeper question is: in this AI war dominated by computing power, infrastructure, and capital, is it really necessary for a purely media company with “social networks” as its core to bet on such a massive AI infrastructure? Does the confidence of this bold gamble come from the huge profits brought by the “fraud” that it ignores or even condones?

Promoting fraud on Meta platform is easier than on Google

Reuters has outlined a “darkest picture” of Meta’s advertising business through previously undisclosed documents: Meta’s platform pushes up to 15 billion “high-risk” scam ads to users almost every day. These advertisements will expose billions of users to the risk of fraudulent investments, illegal online casinos, or the sale of prohibited medical products. The methods of fraud are not limited to paid advertising, and users also encounter 22 billion non paid “fraud attempts” every day, such as false dating profiles. Step by step, Meta’s products have become an indispensable pillar of the global fraud economy.

The conclusion of Meta’s internal research that promoting fraud on the Meta platform is easier than on Google is even more ironic and awkward: Meta clearly lags behind its main competitors in combating fraud. UK regulatory agencies have found that 54% of all payment related fraud losses in 2023 are related to Meta’s products, which is more than twice the total of all other social platforms combined; Meta’s own research estimates that its platform is involved in one-third of successful fraud cases in the United States.

Why is it easier? This is because Meta’s approach appears ambiguous and lacks strength in terms of user protection and compliance. The document shows that the Meta automation system will only prohibit marketers from advertising when there is at least 95% certainty that they have engaged in fraudulent behavior. For those who have a low degree of certainty but still believe that advertisers are likely scammers, Meta does not directly ban them, but implements “punitive bidding”, which means increasing advertising rates.

This means that marketers suspected of fraud can continue to advertise on their platforms as long as they are willing to pay higher fees. This mechanism of “substituting punishment for prohibition” essentially blurs the boundary between platform management and “revenue generation”, making Meta to some extent an “intermediary” for charging and releasing fraudulent activities.

Internal documents even record ‘high-value accounts’, such as advertisers with high spending. Even if they accumulate more than 500 violations, Meta will not ban their accounts, which is undoubtedly a serious act of releasing funds.

All of this puts users in an extremely passive situation. On Meta, a recruitment officer account of the Royal Canadian Air Force was hacked, and hackers used her name to post cryptocurrency fraud messages, causing her former colleague to lose 40000 Canadian dollars. Despite the victims and dozens of their friends submitting over 100 reports to Meta, the account remained active for several weeks without anyone paying attention. This is not an isolated case. A 2023 document shows that Meta rejected almost 96% of the approximately 100000 valid fraud reports submitted by users. Erin West, a former prosecutor and head of a non-profit organization, bluntly stated that Meta’s default response to users reporting fraudulent behavior is to ignore it.

Faced with regulatory pressure, especially the investigation of financial fraud advertisements by the US Securities and Exchange Commission (SEC), Meta internally weighed the economic pros and cons and settled the accounts before choosing to condone it. A November 2024 document cruelly states that Meta earns $3.5 billion every six months solely from fraudulent advertisements with “high legal risks,” and this figure is almost certain to exceed “any regulatory settlement costs related to fraudulent advertising,” as internal estimates suggest that US regulatory fines may not exceed $1 billion. This means that Meta’s income from fraud in the short term far exceeds the fines it may face. The document even suggests that the company’s leadership has decided to take more measures to scrutinize advertisers only when regulatory action is imminent, rather than taking proactive action.

Meta’s current tightrope like business model raises questions about its confidence and ethical foundation for transformation. If a trillion dollar tech giant needs to rely on condoning fraud to “inject” its AGI ambition, will it be overshadowed by its moral shortcomings?

The speed of making money is not as fast as flowers. Did Meta suffer big losses from AI?

It is precisely with this unsettling contradiction that Wall Street seemed to hear a familiar and piercing alarm when Mark Zuckerberg announced in an almost fateful tone at the latest earnings conference that “we must accelerate the process” and promised to significantly expand capital expenditures by 2026.

This scene seems familiar. Just a few years ago, he also took such a gamble and announced at the Connect conference that he would bet the fate of the entire company on the “metaverse”, not only renaming Facebook to Meta, but also investing billions of dollars annually in Reality Labs. Two years have passed, and the result is that stock prices continue to bottom out, and investor confidence has dropped to freezing point.

Nowadays, the script remains almost unchanged, except that the protagonist has changed from “metaverse” to “AGI data infrastructure”. As soon as the huge capital expenditure commitment was made, Meta’s stock price plummeted again, and its market value evaporated by billions of dollars in an instant. Meanwhile, Microsoft’s stock price only fell slightly by about 3%, while Amazon and Google even saw their stock prices rise due to increased spending expectations. Against the backdrop of different market reactions from peers, Meta’s situation is even more passive.

In fact, since Zuckerberg announced a comprehensive shift towards AI, Meta’s stock price has been experiencing cyclical and violent fluctuations. This former social giant is caught in a slow and painful tug of war: on one hand, Zuckerberg wants to quickly reach the future he firmly believes in, and on the other hand, investors who have lost confidence in the “pie chart”.

In terms of revenue performance alone, Meta has delivered a fairly impressive performance report for this quarter.

According to the third quarter financial report of 2025, the company’s revenue reached 51.2 billion US dollars, a year-on-year increase of 26%, setting a new historical high, mainly due to the strong driving force of advertising business. What is even more noteworthy is that Instagram has surpassed Facebook for the first time in terms of advertising revenue growth, indicating that the Meta social advertising matrix is moving from being “unique” to “multi-point resonance”. In addition, Meta expects its social advertising revenue in the United States to further increase to $78.9 billion by 2025.

Behind this growth, the AI driven advertising platform Advantage+has played a core role. As an important carrier for the implementation of Meta AI technology, Advantage+has achieved full process automation from advertising creation, placement to management. It can not only diagnose placement problems in real time, but also provide accurate optimization suggestions, thus fully unleashing the potential of advertising creativity.

To further improve conversion efficiency, Meta is also continuously optimizing brand conversion efficiency, such as launching features such as “one click direct brand private messaging”, which greatly simplifies the user flow path. It can be said that in the existing gameplay system of social advertising, Meta has explored the advertising flow effect to a relatively extreme extent.

The data also confirms the return on investment in AI: in the second quarter of 2025, the improvement of AI recommendation systems increased the usage time of Facebook and Instagram users by 7% and 6% respectively; The AI driven video recommendation system Reels has driven a year-on-year increase of over 20% in video viewing time, significantly increasing advertising exposure.

However, standing on the opposite side of the $51.2 billion revenue growth, Meta has raised its growth forecast for the third time this year, with capital expenditure guidance for the third quarter rising to $66 billion to $72 billion, mainly for the construction of AGI data center clusters and changes in AI talent.

Amazon、Meta、 Expected capital expenditures of Google and Microsoft

Currently, Meta’s first AI data cluster “Prometheus” is planned to be put into use in Ohio in 2026, and is expected to provide at least 1GW of computing power.

But it is precisely these constantly expanding infrastructure ambitions that have intensified investors’ concerns: the market is beginning to question whether such massive capital investment can truly translate into revenue growth that matches it? Does Meta really have the ability to turn AI infrastructure into a ‘good business’?

At the same time, the organizational level turbulence is equally unsettling. After a previous round of heavy investment in recruiting AI talents, Meta has recently launched another organizational restructuring, laying off about 600 employees, affecting the FAIR cutting-edge research team and AI basic research institute. This frequent team restructuring raises doubts about whether Meta has figured out how to effectively integrate AI with existing businesses internally? Can the turbulent organizational structure sustain true technological breakthroughs?

Under the shadow of these uncertain factors, the development prospects of Meta’s Llama model also appear uncertain, making it difficult to see significant results in the short term. Especially the latest generation open source model Llama 4 has achieved a certain adoption rate in the developer community, but its performance still lags significantly behind closed source leaders such as OpenAI’s GPT-4o and Google’s Gemini 2.5 in benchmark tests of multiple key capabilities. Even in high-end application scenarios such as code generation and complex inference, it has not established a significant advantage compared to top open source models in the same category.

The last straw that crushed investors’ trust may come from the vague statements made by the management during the financial report conference. When asked multiple times about the specific integration path of AI with the company’s future strategy, neither Zuckerberg nor CFO Susan Li gave a clear response, but repeatedly emphasized that “capital expenditures will continue to increase”. This communication style that only talks about investment and not about paths undoubtedly further undermines the market’s confidence in Meta’s strategic execution.

Can Meta do without AI infrastructure?

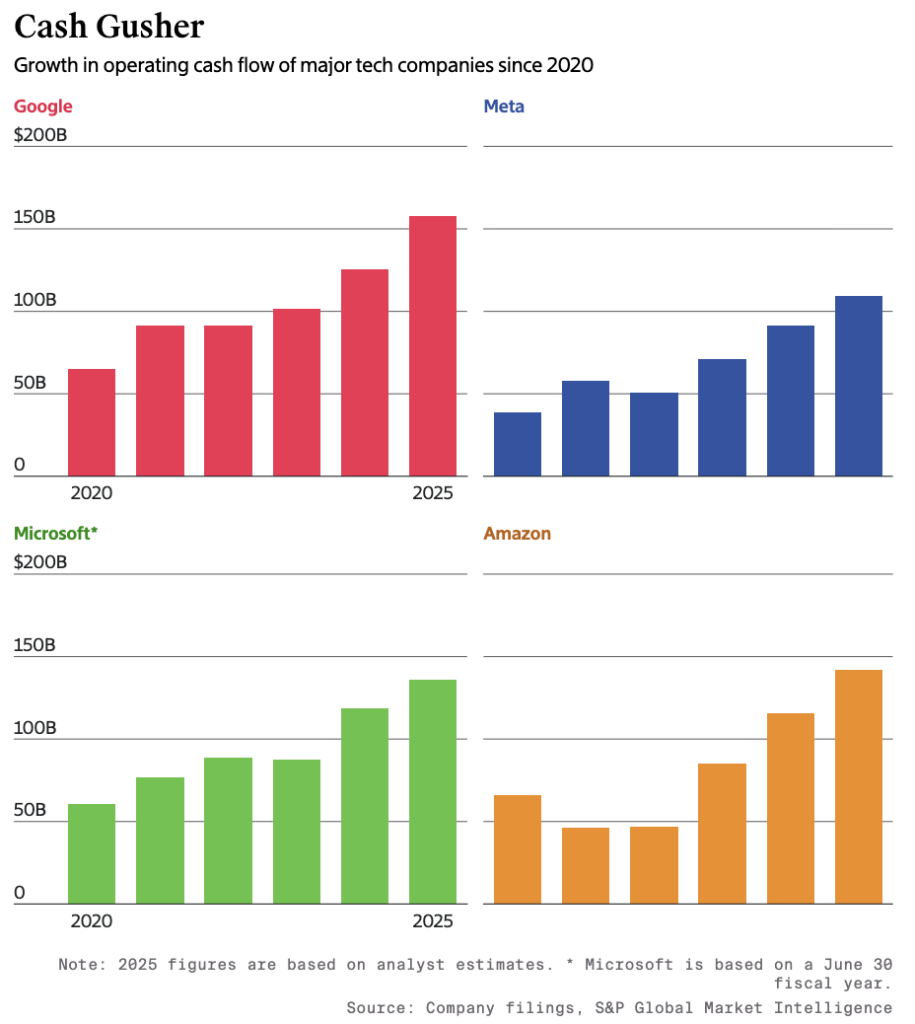

Another major reason for the sharp decline in stock prices is that many investors find it difficult to understand why Meta is so obsessed with AI infrastructure: because it neither has cloud businesses like Microsoft Azure or Google Cloud to undertake and share huge investments, nor does it have a clear path to convert AI capabilities into actual revenue. Meta’s cash flow is not sufficient to ignore investment returns.

So, why does Meta still take a gamble? From the existing public information, it can be inferred that there are three main reasons:

Firstly, compete for the “right to define the entrance”. AI is reshaping the paradigm of human-computer interaction, and in the future we may no longer need countless independent apps, but instead schedule everything through one or a few super AI portals. At that time, the distribution power of content and services will be highly centralized. If Meta abandons the self research of the general model, it will be tantamount to giving the “ticket” of the next era to OpenAI, Google and Microsoft – which is no different from repeating the mistake of being “beaten” by the app store in the mobile Internet era. Obviously, Zuckerberg is unwilling to make the same mistake again.

Secondly, to continue its ultimate vision of the ‘metaverse’. Whether building an open virtual world or creating iconic metaverse experiences, it heavily relies on powerful universal AI models and the underlying computing infrastructure. From the moment he renamed Facebook to Meta, Zuckerberg had already bet the company’s fate on this future, with AI infrastructure being its indispensable cornerstone.

Thirdly, pave the way for its hardware strategy. Since acquiring Oculus in 2014, Meta has never stopped exploring hardware. From Quest Pro to Ray Ban Meta smart glasses, and then to Orion AR glasses under development, the goal has always been to occupy a place in the next generation of human-computer interaction devices. In the era of AI defining hardware, having a self owned large model that can be called across devices has become a necessary condition for the success of its hardware strategy.

It can be clearly seen that unlike Google and Microsoft using AI to enhance existing businesses and smoothly transition to the next era, Meta’s bold gamble is to win a “ticket” to a new era, a future with more possibilities.

Amazon、Meta、 Expected cash flows from Google and Microsoft

However, the cost of this bold gamble is extremely high, especially as the profits from AI infrastructure are flowing upstream on a large scale. Chip giants such as Nvidia and TSMC have captured most of the orders, while model manufacturers bear heavy procurement and operating costs. What’s even more serious is that the speed of technological iteration is far faster than before: the lifespan of cloud service provider chips is shrinking from 5-6 years to possibly only 3 years left, and data center technology may become outdated within 5 years, which means that sky high infrastructure investments face extremely high depreciation risks.

Against the backdrop of chips devouring most profits and insufficient computing power, the question mark remains whether massive capital investment can lead to sustainable profits.

Anticipating this, tech giants are actively exploring profits elsewhere. Whether it’s B2B enterprise services or C-end subscription applications, existing model vendors hope to cater to the market to support early-stage research and development investment. The reason why Meta is betting on both big models and XR hardware may be precisely to open up diversified business lines and inject blood into this survival battle that concerns the future.

Why has Meta encountered numerous difficulties on the path of transformation?

When a technology company grows into a giant, the pain of transformation almost becomes an inevitable watershed of fate. Smooth sailing companies like Google and Nvidia always have precise positioning at the turning point of the technology wave, seizing the opportunity to move forward; Twisted and tortuous companies like Microsoft and Intel often need to go through several trial and error processes and refactoring to find the path to new growth.

As the youngest member of the trillion dollar market cap club, Meta’s growth path was once seen as a model, achieving explosive growth in the golden age of digital advertising with its powerful social network effect and global demographic dividend. However, it is precisely this “youthfulness” that reveals a gap between it and mature giants in judging the timing and planning the path of transformation.

Especially when Meta launched two major strategic shifts in just four years, from “metaverse” to “AGI infrastructure”, the market saw the founder’s courage to subvert themselves, but also exposed their lack of thinking in strategic coherence and business collaboration. Investors and internal teams find it difficult to see a clear and credible growth curve, and instead witness companies betting heavily on an unquantifiable future when multiple industries are still in their early stages.

It can be said that Zuckerberg has always been actively exploring various possibilities for the future, but Meta as a whole is still in the growth and exploration period of a “young company” – daring to try and make mistakes, but also prone to wavering. The journey towards General Artificial Intelligence (AGI) is destined not to be a short-term battle, but a long-term war involving endurance, funding, and faith.

In this war, what Meta needs to win the most may not be technological breakthroughs, but the trust of investors. At a time when the vision has not yet been converted into revenue and investment continues to increase, convincing the market to remain patient will rely heavily on the founder’s personal credibility and persuasiveness, which will be the biggest test Zuckerberg faces as a leader.

暂无评论内容