Citibank: New trend of 'one-day settlement' reduces risk, but transaction failure rate may increase

Global Securities Markets Accelerate Settlement Cycles: Shift to T+1 Gains Momentum Amid Opportunities and Challenges

Since May of last year, the settlement cycle for U.S. stocks has been shortened from two days (T+2) to one day (T+1). Currently, Singapore’s stock market still operates on a two-day settlement cycle (T+2).

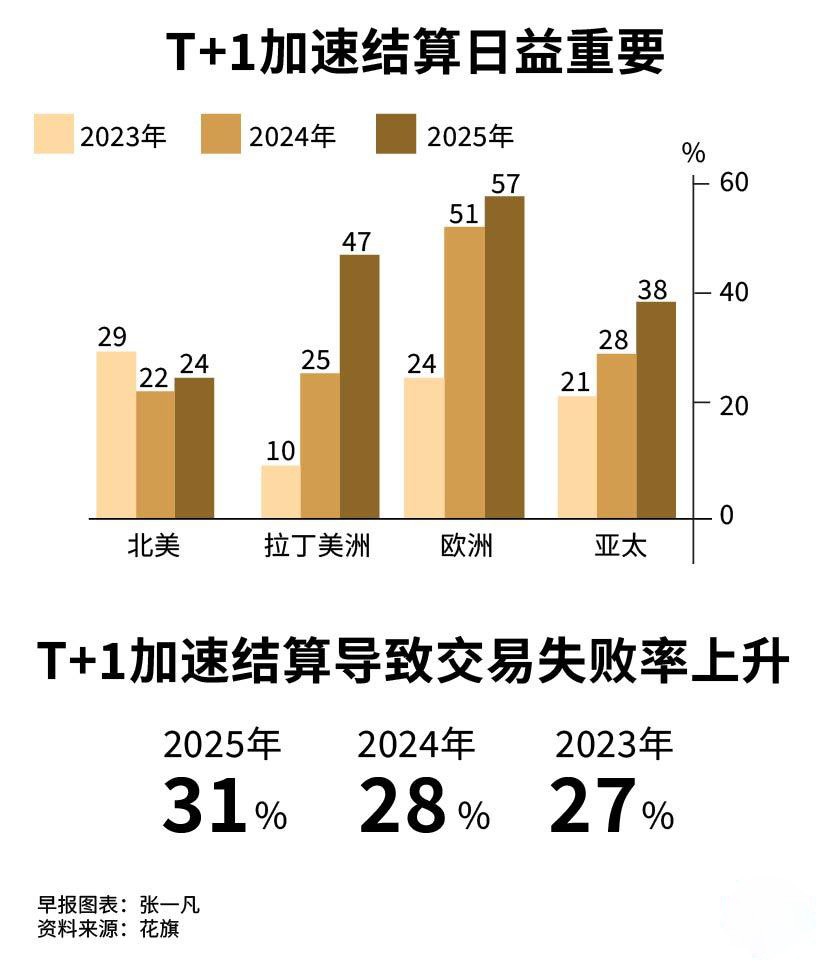

As global securities markets accelerate their settlement cycles—with more markets adopting the one-day settlement cycle (T+1)—a latest report from Citigroup Inc. (Citi) indicates that 76% of financial institutions worldwide will be engaged in T+1 or shorter settlement cycle-related projects by 2025.

While the T+1 settlement cycle helps reduce credit and market risks, it also intensifies pressures related to trade failures, fund liquidity management, and cross-border settlements. T+1 means that for stock trades executed on the trading day (T day), the delivery of funds and stocks is completed on the next trading day (T+1 day), after which the stocks and funds are officially credited to the respective accounts.

Citi points out that the continuous growth of retail investors globally has amplified the pressure for securities market transformation, particularly driven by digital brokerage platforms such as Trade Republic and Robinhood. These high-tech platforms demand round-the-clock, low-cost market access—covering trading in both cryptocurrencies and traditional securities—posing challenges to financial market infrastructure.

These digital brokerages have not only fueled the growth of digital services but also driven reforms in areas such as 24/7 clearing and exchange-traded fund (ETF) management. The shift to the T+1 settlement cycle is one such key reform.

Europe Targets T+1 Shift by October 11, 2027

According to Citi’s report, Europe plans to transition to the T+1 settlement cycle on October 11, 2027, covering 29 markets across the European Union (EU), the United Kingdom (UK), and Switzerland. Latin American countries are closely following: Chile, Peru, and Colombia are scheduled to launch their T+1 transitions in the second half of 2027, while Brazil is expected to complete its transition by February 2028.

In Asia, China already shifted to the T+1 settlement cycle back in 2014. India completed its phased transition to T+1 in 2023, and as of 2025, foreign investors in India will have the option to use same-day settlement (T+0). Other Asian markets, including Hong Kong (China), Japan, Malaysia, and Singapore, are currently conducting consultations on adopting the T+1 settlement cycle.

Post-T+1 Implementation Challenges: Rising Trade Failure Pressures

However, one year after North America implemented the T+1 settlement cycle, 31% of respondents this year reported that their institutions have been significantly impacted by trade failure pressures—a figure higher than those in the previous two years.

This indicates that institutions still need to continuously manage and support faster settlement processes, with market participants outside North America facing more pronounced challenges.

Digital Assets and DLT: New Drivers for Post-Trade Services

On the other hand, digital assets and distributed ledger technology (DLT) have emerged as key drivers of global post-trade services. The industry anticipates that by 2030, approximately 10% of global market transactions will involve tokenized or native digital securities. Respondents believe that tokenized assets can enhance the speed and efficiency of capital flow, thereby reducing financing costs and improving banks’ capital allocation.

The report found that the Asia-Pacific region leads in the adoption of digital assets, supported by widespread retail acceptance of cryptocurrencies and efforts by national regulators to promote digital asset projects.

Citi’s whitepaper report is based on a survey of 537 financial industry leaders, covering financial market infrastructure providers, custodian banks, commercial banks, brokerages, asset management firms, and institutional investors.

|