Beneath the halo, the synthetic biology industry is treading on thin ice.

“If that financing round had fallen through, our company wouldn’t exist today,” Zhao Yaran, founder and CEO of Weiming Shiguang, told Huxiu. Two years later, recalling the circumstances of the Series A funding, he still sighed with emotion.

As of November 2025, this 5-year-old synthetic biology startup has completed 6 rounds of financing, with a valuation exceeding $100 million. It also gained unprecedented attention through its partnership with L’Oréal signed a few months ago. In its most recent funding round, the company secured support from investors including Huatai GenScript, which has a background in the pharmaceutical industry.

Public data shows that Weiming Shiguang has over 100 clients including L’Oréal, Nice Group, and Bloomage Biotech, along with 158 raw material registrations approved by the National Medical Products Administration (NMPA). The currently popular Type XVII Collagen has also been put into mass production; in the cutting-edge field of plant callus extracts, the number of its registered new raw material products accounts for more than half of the total. These are the fundamentals that earned it favor from industrial investors like L’Oréal.

Yet none of this might have happened at all.

The moment that left Zhao Yaran deeply moved took place three years ago, in 2022, when US dollar funds were retreating on a large scale. Weiming Shiguang, which was in a critical phase of commercialization, was in urgent need of capital to build a factory. During the COVID-19 pandemic, Zhao Yaran would get ready every day, finish a simple breakfast, and then sit in front of his computer waiting for scheduled online meetings with investors. In that month of roadshows, he met with three to four investors on average each day, talking to representatives from nearly 70 investment institutions in total. “I basically met almost every investor in the industry,” he said.

After painstakingly finalizing the investment, the co-investors suddenly changed their minds right before the scheduled closing in November. “There was a sudden funding gap of over 20 million yuan, and my head was buzzing at that moment,” Zhao Yaran told Huxiu. His biggest fear was that the withdrawal of co-investors would lead the lead investor to pull out as well.

At that time, still in the midst of the pandemic, the cash on Weiming Shiguang’s books could only sustain basic operations for one year. If the funding failed to come through, the factory construction plan would be scrapped, orders could not be delivered on schedule, and the company would essentially be in a state of slow death.

Many companies were not as lucky as Weiming Shiguang. Since 2022, several well-known synthetic biology firms have gone bankrupt or fallen into crisis, including Amyris, hailed as the pioneer of synthetic biology.

Amid the drastic shifts between boom and bust and the twists and turns of fate, Weiming Shiguang and the synthetic biology sector it belongs to are being swept up by new technological waves such as AI, surging into a brand-new development phase filled with infinite possibilities yet extremely low fault tolerance. How to navigate the path ahead is a crucial question that every player must carefully address under the dazzling spotlight.

Being Favored by Multinational Pharmaceutical Giants Is Only the Starting Point

Zhao Yaran believes that the core trait of Weiming Shiguang is “pragmatism”. “We were never the darlings of the capital market, and there was a lot of noise along the way, but we just kept working steadily on what we believed was right.”

This pragmatism is reflected to a certain extent in the prudence of strategic choices and the determination in execution. In fact, the key event that propelled Weiming Shiguang into the limelight was securing investment and reaching a strategic cooperation with L’Oréal, and the key substance—Type XVII Collagen—is exactly a testament to this “pragmatism”.

The company chose Type XVII Collagen, a substance with “huge scientific potential but unknown market prospects”, instead of Type III Collagen, which had “a mature market but was destined to be highly competitive”.

“The internal debate was quite intense,” Zhao Yaran told Huxiu. The voting results at that time fully demonstrated how difficult the decision was—with 4 in favor and 2 against among the 6 core team members.

Today, collagen is an undisputed blockbuster product. However, back in 2021, the collagen industry was still in its infancy. Giants Bio and Jinbo Bio, which later became red-hot players, had just launched their IPO processes or were still in the preparation stage. In the collagen market, Type I Collagen dominated, Type III Collagen was just taking off, and Type XVII Collagen existed only on paper in academic papers.

From a commercial perspective, choosing Type XVII Collagen was undoubtedly a high-risk bet.

“Genetic evidence drove our decision,” Zhao Yaran told Huxiu. In a paper published in a top academic journal, researchers knocked out the COL17A1 gene, which is responsible for synthesizing Type XVII Collagen, and the skin and hair condition of the experimental mice became as poor as those on the verge of death. “We come from a background in classical genetics, so we trusted this evidence more,” he said. The team also aspired to develop a “First-in-class” product.

Later, as they learned more about business operations and went through a series of financing crises, Zhao Yaran once hesitated and wavered. It was not until 2025, when the company caught the eye of multinational giant L’Oréal and secured the highly anticipated industrial investment, that he finally breathed a sigh of relief. “It seems we made the right choice back then.”

More importantly, amid the investment boom, the company chose the seemingly unglamorous path of “focusing on high-value active ingredients with relatively fragmented but clearly defined demand in the consumer healthcare sector”.

It is worth noting that Weiming Shiguang was founded at the peak of investment and financing activity in the synthetic biology sector.

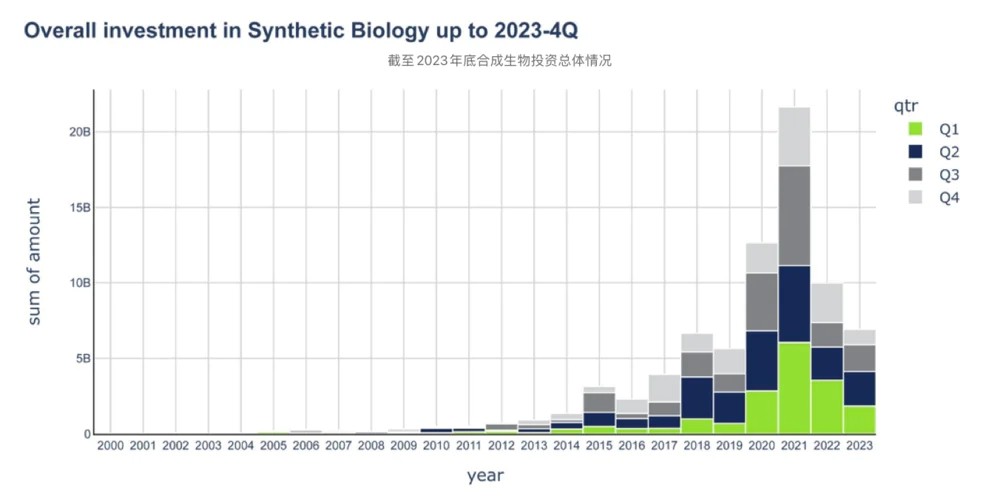

Data from Synbiobeta shows that global synthetic biology financing reached $7.8 billion in 2020, double the amount of the previous peak. By 2021, this figure soared to nearly $20 billion, with the number of financing deals also hitting a new high, representing a year-on-year growth of over 100% in investment scale.

According to data from Zhiyan Consulting, the market size of China’s synthetic biology industry was nearly $4 billion in 2020, and surged to $6.416 billion in 2021, a year-on-year increase of more than 150%.

At a time when the world was captivated by synthetic biology’s ability to blur the boundaries between living and non-living matter, universal platforms and bulk raw materials were the most sought-after areas of focus.

Looking ahead to future development directions, Zhao Yaran still favors “niche segments”. He believes that compared to collagen, plant callus extracts, which are still unfamiliar to the general public, will have greater market prospects in the future.

Known as “plant stem cells”, these cell clusters can “revive” plant tissues, and their active metabolites can be widely used in cosmetics, food, pharmaceuticals, and other fields. This is also a sector that the company has resolutely focused on from the very beginning, positioning itself as a plant cell factory. Data from the NMPA shows that the proportion of plant callus-based products in new raw material registrations is on the rise.

Furthermore, according to a L’Oréal representative in a media interview, what the company values about Weiming Shiguang is its AI-driven design platform and “versatile biological capabilities”, which will be integrated with L’Oréal’s scientific expertise in skin, hair, and scalp biology. However, the cooperation between the two parties is not limited to the discovery of new bioactive substances; it will also extend to streamlining the process from design to large-scale production.

For players like Weiming Shiguang in the synthetic biology industry, both their own development and their impact on existing industrial models have only just begun.

Global Synthetic Biology Investment Landscape as of the End of 2023

(Although the latest data indicates a recovery in investment in 2024, with total funding reaching $12.2 billion, a year-on-year increase of 14%, it still lags far behind the peak level.)Source: Synbiobeta Synthetic Biology Investment Report

The Road Ahead Will Be Even Tougher

“The window of opportunity has almost closed; the era of mass entrepreneurship in the biosynthesis sector is over,” Zhao Yaran told Huxiu when discussing the current entrepreneurial landscape. This means that competition in the synthetic biology field is entering a phase of stock competition, a battlefield exclusively for players that have survived life-or-death struggles.

When asked if he would still resolutely choose Type XVII Collagen if he could go back to November 2021, Zhao Yaran thought for a moment and said yes. However, judging from his assessment of the industry, it is questionable whether he would still commit to a product with uncertain commercial prospects if he were to start a business today.

The harsh reality that must be faced is that compared to financial capital, state-owned capital and industrial capital are more pragmatic and cautious with their investments. Their investment logic no longer focuses solely on storytelling and potential market size; instead, they prioritize the ability to deliver tangible results and ensure stable supply.

In fact, Weiming Shiguang was born with a “silver spoon in its mouth”. Zhao Yaran himself is a PhD graduate under Academician Deng Xingwang from Peking University. Other core team members, including Chen Jiayue, Li Yufan, and Lin Xiaomei, are all PhDs from Tsinghua University and Peking University. The company is backed by two major research laboratories: the Peking University Key Laboratory of Protein and Plant Gene Research and the Tsinghua University Key Laboratory of Industrial Biocatalysis.

These credentials enabled the company to complete two rounds of financing in its first year of establishment, with some investors even willing to value it at $100 million. “Valuations were sky-high back then,” Zhao Yaran told Huxiu.

However, in the investment logic of industrial capital, team background and technical capabilities are merely a “ticket to get in the door”—enough to secure a meeting. The ultimate decision to invest hinges on comprehensive capabilities such as product efficacy proven by market validation and stable production capacity. “It was only because we could mass-produce the raw materials, deliver proven efficacy, and avoid major manufacturing hiccups that they finally recognized us,” Zhao Yaran said.

Under this logic, if a startup fails to hit key milestones before the next financing round, it is likely to face a cash crunch and even bankruptcy. New entrants are forced to make more prudent and pragmatic choices. This has become the defining trait of the new generation of synthetic biology companies that have survived the previous round of industry consolidation.

From this perspective, Weiming Shiguang’s ability to weather the 2022 financing crisis also had an element of luck. It happened to reach the commercialization stage at that time, and just caught the tail end of the massive financial capital investment in synthetic biology.

In fact, the company first came to L’Oréal’s attention as early as 2023, and it took two years of collaboration before the investment was finally finalized.

Zhao Yaran told Huxiu that with the new round of financing, Weiming Shiguang will continue to deepen the development of its AI technology platform, which he regards as “the engine for material design”. Additionally, the company is working to diversify its application scenarios and expand its global distribution channels.

“We aim to become the BASF of the biomanufacturing sector,” Zhao Yaran told Huxiu. He divides the company’s development into three phases: 0 to 1, completing initial commercial validation; 1 to 10, becoming a leading player in China; and 10 to 100, expanding globally. For now, he admits that the company has “just completed the first phase”.

(BASF, a global chemical giant founded in 1865, recorded nearly RMB 500 billion in revenue in 2024)

History is repeating itself in a new cycle. Over a century ago, BASF started with Tyrian purple, an expensive dye extracted from tens of thousands of murex snails. Through chemical synthesis, it transformed the dye into the globally popular indigo blue for denim, turning color from a privilege of the nobility into an everyday staple for the general public. Since then, synthetic chemistry has reshaped human life in terms of food, clothing, housing, and transportation. However, this progress has come at a cost, bringing about a growing number of pressing issues such as climate change and food safety concerns.

Today, synthetic biology is targeting territories that chemical processes have not yet fully conquered. Combined with new technologies like AI, it is embarking on a new round of exploration to transform human life, starting with the goals of “beauty equity” and “health equity”. What kind of impact will it bring to humanity?

|