The PC industry is grappling with severe challenges brought on by the intensifying shortage of memory chips. According to the latest warning from market research firm IDC, the acute memory crunch is likely to persist until 2027, triggering a chain reaction across device manufacturers and end-users. Data from TrendForce shows that starting from the third quarter of 2025, the global DRAM industry has seen a substantial quarter-on-quarter increase in revenue, with contract prices for some products projected to jump by as much as 45% to 50% in the fourth quarter. Jeffrey Clarke, Chief Operating Officer of Dell, went so far as to state that he has never witnessed such a rapid escalation in costs. This crisis is expected to drive up the average selling price of PCs in 2026 while further dragging down market shipments.

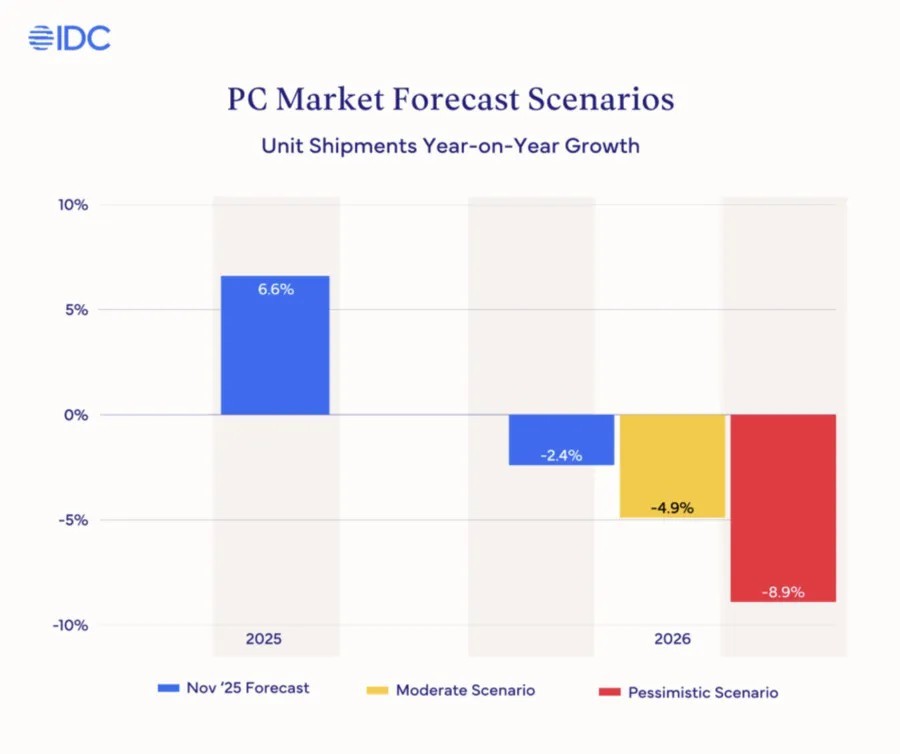

The impact of this supply crisis on the PC industry has been immediate. Major PC manufacturers including Dell, Lenovo, HP, Acer, and ASUS have issued warnings to their customers, confirming that product prices will be raised, with general increases ranging from 15% to 20%. In response, IDC has updated its forecasts with two scenarios: under a moderate scenario, global PC shipments in 2026 may decline by 4.9% year-on-year; if conditions worsen, the drop could widen to 8.9%. Concurrently, the average selling price of PCs is anticipated to rise by 4% to 8%. Market analysts suggest that leading brands with large shipment volumes, armed with stronger inventory capabilities and greater bargaining power in the supply chain, will be better equipped to weather the storm and may even seize market share from smaller regional brands.

This shortage has dealt a particularly harsh blow to the PC industry, which finds itself at a critical juncture. On one hand, the end of support for Microsoft's Windows 10 operating system was supposed to drive a wave of device upgrades; on the other hand, the industry is aggressively promoting AI PCs that demand more memory. However, the soaring cost of memory has made it extremely difficult to offer high-capacity memory configurations at competitive price points. IDC points out that just as the industry recognized the need to increase memory capacity, its cost has become prohibitively expensive, potentially leading to higher prices for new products, squeezed profit margins for manufacturers, and even forcing some new systems to be released with reduced memory specifications. Analysts argue that this could slow down the widespread adoption of AI PC capabilities.

The impact has not been uniform across different market segments. Gamers and DIY enthusiasts have been hit particularly hard. Prices of standalone memory modules in the spot market have been skyrocketing, changing almost daily. Some retailers have noticed that the wholesale prices for certain hard drive models have doubled over the past few months. As a result, Framework, a modular laptop company, has removed all standalone memory kits from its store shelves. Analysts note that the cost of building a PC from scratch will rise significantly, which may prompt some consumers to shift towards pre-built systems from major OEMs that offer relatively better value for money.

To tackle these challenges, manufacturers like Lenovo have reportedly stockpiled memory at levels approximately 50% higher than normal to navigate the shortage smoothly. Meanwhile, a strategic divide has emerged among some upstream memory giants. Samsung Electronics is reportedly planning to shift part of its HBM production capacity to manufacturing general-purpose DRAM (such as DDR5), which may yield higher profit margins. Micron Technology, however, has opted to more resolutely focus on the data center market, even discontinuing operations of its consumer - facing brand, Crucial. Despite facing severe short - term pressures, the industry is also exploring long - term structural opportunities. This AI - driven "super cycle" has opened a crucial window of opportunity for domestic memory chip manufacturers. As international giants redirect their production capacity towards HBM and high - end DDR5, creating a supply gap in mid - to low - end products, local enterprises like ChangXin Memory Technologies are accelerating technological upgrades and capacity expansion to fill the market void and reduce the industry chain's reliance on overseas production capacity.

|