Who could have imagined that an AI application now generating its own revenue stream was, in its early years, entirely powered by two people manually “faking” AI—validating product-market fit, deeply understanding user pain points, and even earning income in the process?

That company is Fireflies.

If you zoom in on the niche of AI-powered meeting tools, Fireflies.ai stands out as a truly unique startup.

At first glance today, Fireflies.ai might easily be categorized as a “typical AI SaaS company”: automatically recording, transcribing, summarizing, and enabling search across meetings, with some added Agent capabilities—perfectly riding the dual tailwinds of Zoom’s remote work boom and rapid large-model advancements.

Alan Zong, Partner at UpscaleX, a North American investment firm, told Huxiu: “In today’s hyper-accelerated environment of growth and fundraising, speed matters immensely for startups. In the U.S. market, without concrete business metrics demonstrating strong product-market fit (PMF), it’s nearly impossible to secure the next round of institutional funding.”

Unlike the standard AI startup narrative—breakthrough model first, then product, then monetization—Fireflies.ai spent nearly three years iterating through trial and error. During those years, every single meeting summary delivered by Fireflies was painstakingly hand-crafted by its two founders overnight. It wasn’t until late 2019 that the product completed internal testing, officially launched to the public, and finally integrated real AI automation. From that point on, growth accelerated rapidly.

By mid-2025, Fireflies.ai had joined the unicorn club with a valuation exceeding $1 billion, serving over 20 million users and reaching approximately 75% of Fortune 500 companies globally.

But what impresses the market even more than its scale is its rare capital efficiency. While peers burned massive funding rounds, Fireflies.ai achieved triple-digit annual growth almost entirely through self-generated revenue. In June 2025, Fireflies.ai published an official blog post revealing it has remained profitable since 2023 and hasn’t raised any new primary funding since 2021—relying solely on organic business growth to drive valuation increases. According to third-party consulting firm Latka, Fireflies.ai’s annual revenue grew from 4.2millionin2021toapproximately10.9 million in 2024, maintaining a consistent year-over-year growth rate of about 88%.

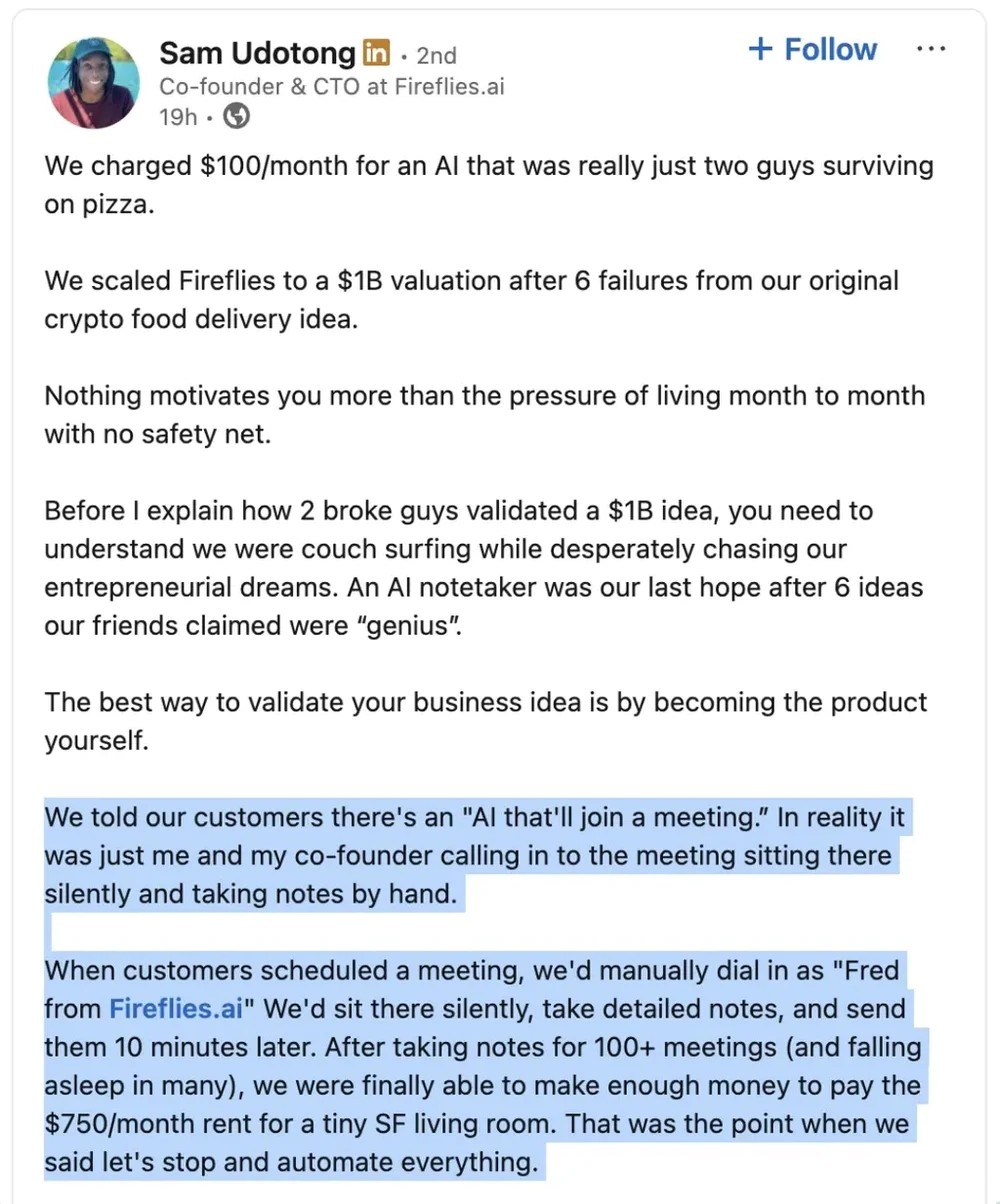

Admitting Their “Cheating” Won Investor Trust

AI meeting assistant startups are common in Silicon Valley—but Fireflies.ai’s origin story is uniquely dramatic: its founders manually simulated an AI product to validate PMF and bootstrap their business.

The two founders themselves are quite legendary.

Krish Ramineni (left) and Sam Udotong (right)

Krish Ramineni and Sam Udotong officially founded Fireflies.ai in July 2016, though their partnership began earlier. They met at the University of Pennsylvania and later attended MIT together—one, a Nigerian-American engineer with aerospace and computer science training; the other, an Indian former Microsoft product manager known for his hands-on execution.

Despite their complementary backgrounds, their entrepreneurial journey started rough.

Udotong later recalled that their early days were defined by “continuous failure.” Before landing on meeting notes as their core idea, they cycled through six different startup concepts—some wildly impractical, like “cryptocurrency + food delivery.”

By 2017, funds were nearly exhausted. They were so broke they couldn’t afford rent, sleeping on friends’ couches and surviving on cheap pizza. The pressure of “one more failure might end everything” forced them to devise an unconventional survival tactic.

Thus, a legendary decision was born: pretend the product already existed—before it was even built.

Udotong recently revealed this story on Linkedin, sending it viral across tech news outlets: in Fireflies’ earliest days, what customers bought wasn’t a real automated “AI meeting assistant.” The so-called intelligent assistant “Fred” was actually just the two founders themselves.

From the customer’s perspective, an AI named “Fireflies Notetaker” would automatically join meetings and take notes. In reality, whenever a client held a meeting, the founders would secretly dial in, put on headphones, listen intently from start to finish, and manually transcribe every word.

As soon as the meeting ended, they’d rush to compile polished notes and send them back, labeled as “AI-generated.”

To sustain cash flow, they charged early users 100permonth.Withthatincome,theybarelycoveredtheir750/month bunk bed rent in a San Francisco shared apartment.

They devoted nearly all their time to “impersonating AI,” attending over 100 online meetings per month—sometimes dozing off mid-call from exhaustion. Absurd as it sounds, this experience became their turning point: although they never disclosed that “Fred” was human, most clients were highly satisfied with the note quality and kept paying.

This unexpectedly confirmed a crucial insight: the market genuinely needed this product.

With this few-thousand-dollar lifeline, the founders survived—and more importantly, the manual simulation gave them deep clarity on what made meeting notes truly useful, solidifying their conviction in this direction.

In late 2017, they discontinued all manual services and focused entirely on building a real automated product—laying the foundation for Fireflies’ future success.

Of course, this approach later sparked controversy. But by the time they sought formal investment, the practice had long ceased, and the team was deep into developing genuine AI capabilities.

By late 2019, Fireflies.ai had built a functional automated meeting platform. After internal testing, they presented it to investors. Surprisingly, when they candidly shared their “human-as-AI” origin story, investors didn’t recoil—in fact, they gained greater trust in the team’s pragmatic, demand-first mindset.

Fireflies thus secured seed funding smoothly and gradually grew into the billion-dollar unicorn it is today.

Product-Led Growth

In one sentence, Fireflies turns spoken words into structured data—not just capturing meeting outcomes, but preserving the full context behind decisions, something enterprises have long sought but struggled to achieve.

If you view Fireflies.ai merely as an automated meeting transcription tool, you’re severely underestimating it.

What truly sets Fireflies apart from other AI meeting assistants isn’t transcription accuracy or summary quality—it’s that from day one, it tackled a deeper problem: how to transform “spoken words” into reusable, value-generating enterprise data assets.

Many AI meeting tools simply compress conversations into summaries. Fireflies, however, aims to close the loop on meeting data workflows—ensuring discussions, disagreements, and trade-offs can all be revisited, searched, and reused. To achieve this, Fireflies embedded advanced features like AI Agents.

This is Fireflies’ core differentiator.

On one end, it’s a fully automated platform for recording, transcribing, searching, and analyzing meetings. On the other, it functions as an internal conversational knowledge base—turning ephemeral spoken words into durable, extractable assets.

To realize this advantage, Fireflies built a tightly integrated three-layer product architecture.

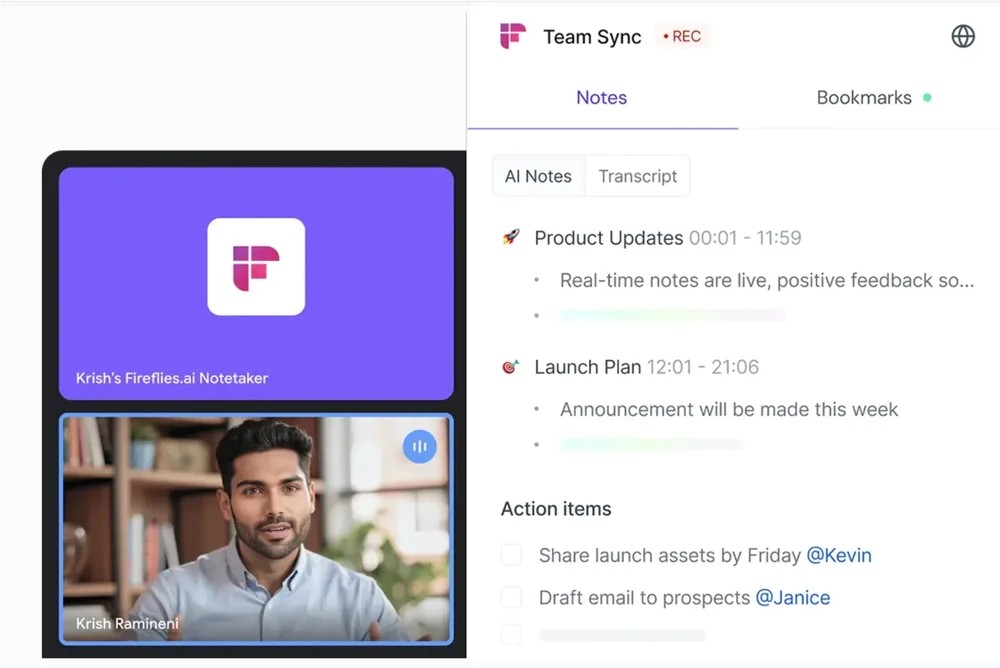

First is the “Fireflies.ai Notetaker” bot—internally nicknamed Fred—a virtual colleague you invite into Zoom, Google Meet, Teams, and other platforms. It dials in automatically, records audio, and transcribes everything.

All recordings flow into a web-based Dashboard—essentially a “meeting inbox” or “Meeting Notebook”—where users can search, replay, annotate, and collaborate on past meetings.

Beneath that lies the integration layer: via Chrome extensions, APIs, and Zapier, Fireflies pushes meeting data directly into CRMs, project management tools, and collaboration platforms like Salesforce, HubSpot, Notion, and Asana—transforming discussions into actionable tasks and searchable records.

Underpinning it all is a “universal meeting capture” technical architecture.

Fireflies’ foundational capability is “cross-platform agnosticism.” It doesn’t lock into any single meeting provider but acts as a neutral recording layer.

Users simply connect their Google or Outlook calendar. Fireflies then auto-detects video meeting links and joins punctually—whether it’s Zoom, Google Meet, Teams, Webex, Skype, RingCentral, Aircall, or other niche tools—behaving exactly like a human attendee to capture the audio stream.

After the meeting, Fireflies doesn’t stop at transcription. It actively distributes insights: summaries auto-post to Slack channels, action items sync to Asana or Microsoft To Do, and key call details populate CRM records for follow-up.

One user shared that after 30+ client meetings in a month, Fireflies silently synced 20+ transcripts to Slack and Notion. His takeaway? “My favorite part isn’t the transcription—it’s that I never have to worry about where all this stuff should go.”

For speech recognition, Fireflies avoids reliance on a single vendor, instead using a “hybrid ASR” strategy to balance cost, speed, and accuracy. For real-time needs—like live captions or instant visibility during sales calls—it uses streaming solutions like Deepgram.

For high-fidelity archival transcripts, it switches to OpenAI’s Whisper for offline processing, which excels with multilingual content, accents, and technical jargon—ideal for producing publication-ready text.

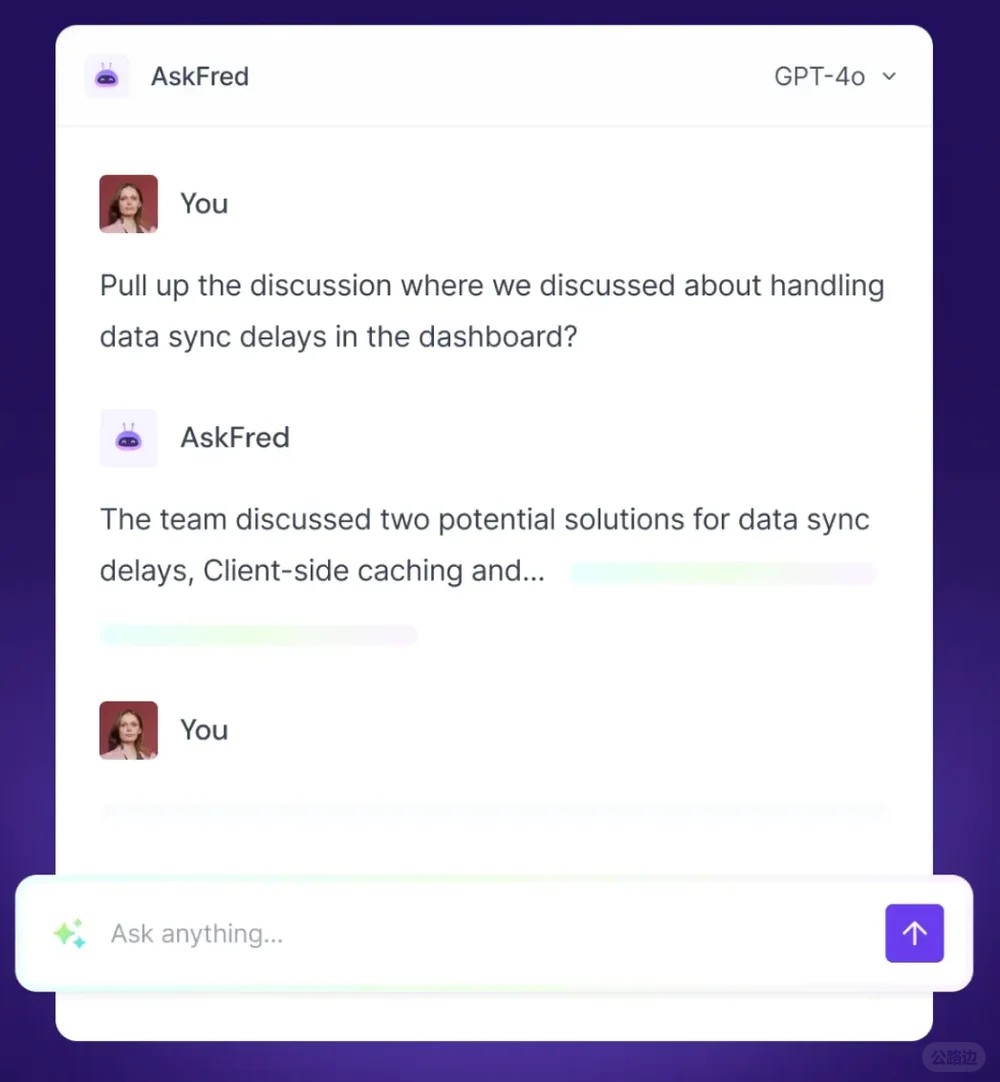

What truly elevates Fireflies from a tool to an AI teammate is “AskFred”—a chat window embedded directly in meeting transcripts.

Powered by large language models, AskFred lets users ask questions like: “What budget did the client mention?” or “Draft a formal follow-up email.”

The key difference? AskFred answers with full contextual awareness of the entire meeting—it can retrieve, summarize, generate new content, and even reason.

For many users, this transcends “transcription + search”—it’s a post-meeting AI assistant that understands business context.

Around this core, Fireflies layers “conversation intelligence” and “smart search.” The former quantifies meeting dynamics—speaking time distribution, speech pace, emotional tone, filler-word frequency—metrics that directly inform sales teams whether they’re talking too much or truly listening.

Additionally, Fireflies allows users to clip and share meeting video snippets directly via email or Slack.

Despite such sophisticated product design, its business model remains refreshingly simple: classic SaaS subscription pricing, amplified by product-led growth (PLG) virality.

Its growth flywheel is visibly powerful: when one user invites the Fireflies Bot into a meeting, the other 5–10 participants (including external clients) see “Fireflies.ai Notetaker” in the attendee list and later receive a beautifully formatted summary email.

Many users discover Fireflies not through ads, but through an email or a meeting—an embodiment of “Product as Marketing”: the product itself is the best advertisement.

Compared to Google’s expensive enterprise contracts, Fireflies prices its business plan at just $19/month—affordable enough for a single Silicon Valley employee to swipe a company card, drastically shortening the purchase decision chain and accelerating adoption.

When you combine all these value propositions, it’s easy to understand why firms like Khosla Ventures bet on Fireflies. As an early investor in OpenAI, Vinod Khosla has long championed the idea that “all software will be rewritten by AI.” In his view, Fireflies in 2021 was a textbook example of AI transforming B2B collaboration—it redefined how teams meet, record, and execute. Fireflies didn’t just capture meeting data; it demonstrated the full potential of an enterprise AI co-pilot—from automating data integration into existing workflows and structuring outputs to enabling intelligent collaboration.

Investors also highly valued Fireflies’ PLG efficiency: extremely low customer acquisition cost and high viral coefficient positioned it to potentially become the next Slack or Dropbox.

Most critically, Fireflies is building a growing “data moat”: with user consent, it has already amassed billions of minutes of meeting data. This corpus could eventually train vertical-specific small language models (SLMs), further enhancing its domain understanding and automation within specific industries and workflows.

For any SaaS company aiming to maintain competitive differentiation in the AI era, this compounding advantage—combining proprietary data with AI capabilities—is the hardest to replicate.

A Crowded Battlefield

Fireflies’ market is expanding rapidly—and becoming fiercely competitive.

It straddles three high-growth domains: Conversational AI, Meeting Solutions, and Sales Intelligence—placing it in a large but intensely contested space.

Multiple research firms estimate the global AI meeting assistant market reached 3.2billionin2025andisprojectedtosurgepast7.3 billion by 2035, growing at a CAGR of 25%–35%.

The U.S. leads this market, holding nearly half the share, while Asia-Pacific—especially India and Japan—is the fastest-growing region due to booming remote outsourcing and frequent cross-language communication.

But precisely because of this explosive growth, AI meeting tools have entered a classic red ocean.

Tech giants moved faster than expected. Microsoft, Google, and Zoom have all embedded AI meeting summaries as native features: Microsoft Teams’ Copilot auto-generates summaries and action items; Google Meet’s Duet AI offers real-time transcription and translation; Zoom’s AI Companion delivers automatic summaries and key-point extraction by default.

For users, these features are frictionless—no installation, no learning curve, no extra cost—bundled directly into existing subscriptions.

Commercially, giants leverage massive user bases and native integrations to squeeze independent players’ room to maneuver.

Among startups, competition is equally fierce.

Fireflies’ biggest rival is Otter.ai—a functionally similar cross-platform meeting assistant. Otter captured vast Zoom user share through its Otter Assistant, surpassing 25 million users, with ARR exceeding $100 million by early 2025.

In comparison, Fireflies reported ~$15 million ARR and ~16 million users at the same time—still a meaningful gap in scale.

Other contenders include MeetGeek, Avoma, and Fathom—each targeting niches like SMBs, sales conversations, or CRM sync. Some, like Grain.ai—which raised $20 million specifically for video meeting clipping—have secured significant funding by telling compelling “productivity stories.”

Overall, no clear winner has emerged among startups, but product differentiation is eroding as features converge. Meanwhile, technical barriers are collapsing: OpenAI’s Whisper and ASR APIs from Deepgram and AssemblyAI keep improving while prices drop. Transcription and summarization are rapidly becoming commoditized.

When anyone can build it, everyone’s offering looks similar, and costs keep falling, hundreds of meeting assistant tools have flooded the market (MeetGeek, Airgram, etc. are just a fraction). With core capabilities now low-barrier commodities, Fireflies must prove that its AskFred, Agent capabilities, cross-system automation, and deep integrations aren’t just convenient—but indispensable—and continuously evolve. Otherwise, it risks being dragged into endless price wars and casually eliminated by giants who can “just add it” to their suites.

|