Goldman Sachs analysts pointed out that the current consumer spending environment is sending out early warning signals, with characteristics almost identical to those before the 2008 financial crisis, and Las Vegas' gambling revenue has once again become the "leader" in measuring economic cycles.

According to a report released by the Goldman Sachs analysis team led by Lizzie Dove, the consumer trend in Las Vegas has begun to decline, reproducing the signs of weakness in the early stages of the economic recession. At the same time, despite the current consumer environment showing K-shaped differentiation and dual track characteristics, this early signal deserves high vigilance from the market.

Goldman Sachs believes that investors should closely monitor consumption trends until early 2026. Although the demand in the aviation industry remains strong at present, if the demand in this field begins to decline in the future, it will be a clear signal that the scope of economic weakness is expanding, which may force Federal Reserve Chairman Powell to be open to more interest rate cuts.

According to the information previously conveyed by Finance Minister Besson, favorable factors for working-class consumers are expected to begin to emerge at some point in the first quarter. At the same time, Goldman Sachs' analytical framework provides important references for identifying the transmission pathways of consumer stress in the tourism and leisure sector.

The transmission path of the decline cycle

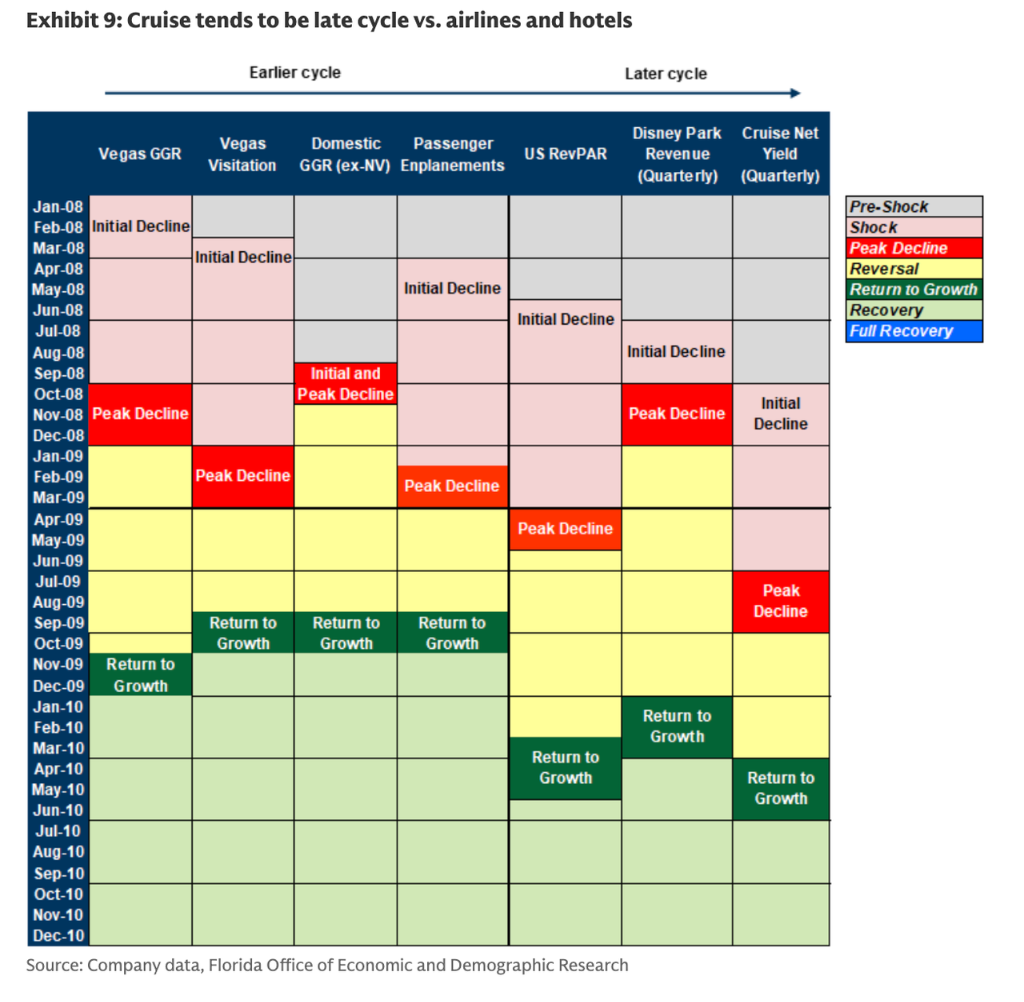

Goldman Sachs analyst Lizzie Dove's research establishes an analytical framework for identifying the sequence of consumer stress transmission by reviewing the reactions and recovery processes of different segments of the tourism and leisure industry during the 2008-2009 recession. Analysis shows significant differences in the timing of decline across different industries.

During the 2008 Global Financial Crisis (GFC), Las Vegas and the aviation industry were the first to be impacted. Las Vegas' gambling revenue began to decline as early as February to March 2008, while airline boarding showed a decline in mid-2008.

In contrast, the decline of the hotel and cruise industries is relatively lagging behind. The revenue per available room for rent (RevPAR) of American hotels only began to decline in the mid to late 2008. The downturn of the cruise industry is usually in the late stage of the cycle, and its net profit margin did not reach its maximum decline until mid-2009, and did not resume growth until mid-2010.

This means that there is a full 18 to 24 month lag between the late cycle downturn in the cruise industry and the early cycle pullback in Las Vegas and the aviation industry.

Warning signals under K-type recovery

Goldman Sachs emphasizes this historical consumption behavior pattern at present because the current K-shaped recovery and differentiated spending environment are flashing early warning signals.

The report points out that the trend in Las Vegas has been pointing downwards, which is in line with the early characteristics of an economic downturn. However, the market is currently showing a fragmented state: airline performance remains robust, and the "baby boomer generation" continues to book Caribbean cruise travel.

Based on historical experience, the downturn in the cruise industry often occurs at the end of the cycle, while the pullback of gambling, aviation, and hotels usually manifests before the cycle turns downward.

Goldman Sachs suggests continuing to track these consumption trends until early 2026 to observe whether the weakness will spread more widely to the entire tourism industry. If aviation demand also begins to decline after Las Vegas, it will provide clearer evidence of the spread of economic weakness, and macroeconomic policy adjustments may become inevitable at that time.

|