In 2025, Mark Zuckerberg launched Meta’s most aggressive overhaul in history: a radical shift in technical direction, organizational restructuring, and massive capital injection. With unprecedented resolve, Zuckerberg set the company on a one-way course forward—this is not just a high-stakes gamble, but Meta’s only shot at survival.

Throughout the year, Meta has been forced to confront a widening gap with OpenAI and Google in the AI race, while enduring successive contractions and reorganizations at the organizational level.

Centered on AI operations, Meta carried out multiple rounds of layoffs and team reshuffles. Some AI-related roles were cut outright, while others were reintegrated into new research and product systems. For a company renowned for its engineering culture, such intensive adjustments sent a powerful signal.

Strategically, Zuckerberg’s moves were equally bold. He secured the services of 28-year-old Scale AI founder Alexandr Wang through a strategic investment of approximately $14.3 billion, and established a brand-new elite research team within Meta called “TBD Lab,” driving the AI transformation through an almost “embedded” management approach.

Inside Meta, tensions deepened between the newly recruited top research team and long-serving “veterans” overseeing core businesses. A high-pressure gamified ranking system and an extremely transparent management style further intensified internal strain.

Layoffs, restructuring, hands-on management, and an accelerating delivery pace all point to an undeniable truth: Zuckerberg’s anxiety is palpable—and it is spreading from the top down.

As 2026 approaches, the outcome of this gamble will soon be revealed: a superintelligence comeback, or a costly strategic imbalance?

I. Meta’s Do-or-Die Gamble

In 2025, as the global tech industry held its breath for every breakthrough in AI, Zuckerberg quietly initiated an unprecedented strategic pivot inside Meta. This is no longer an optimization of existing businesses, but a comprehensive reinvention involving technical routes, organizational structures, financial models, and even corporate culture.

Internally, the year was repeatedly referred to as an “intensity year”; externally, it resembles a gamble Meta cannot afford to lose.

1. Financial Gamble: $70 Billion in a No-Lose AI Arms Race

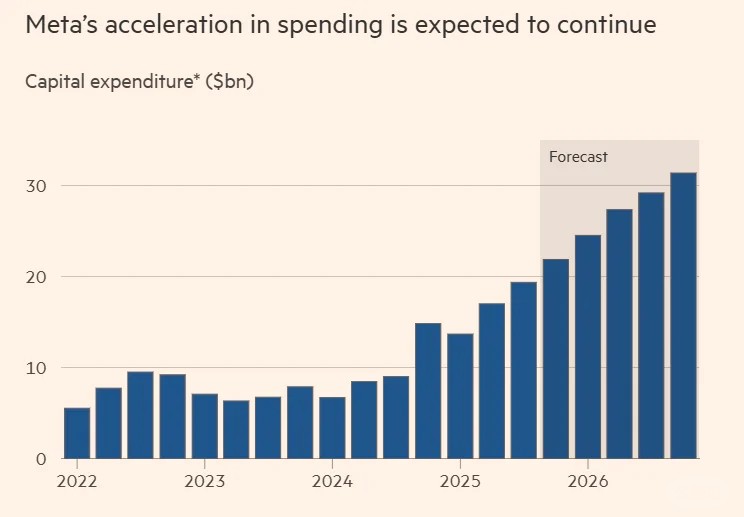

During the January 2025 earnings call, Zuckerberg revealed a stunning figure to investors: Meta would allocate at least $70 billion to AI infrastructure in 2025—nearly double the $39 billion in capital expenditures for 2024.

Later, during the October earnings call, the tech giant announced plans to invest even more in AI next year, potentially exceeding $100 billion.

Capital spending at Meta is expected to accelerate further.

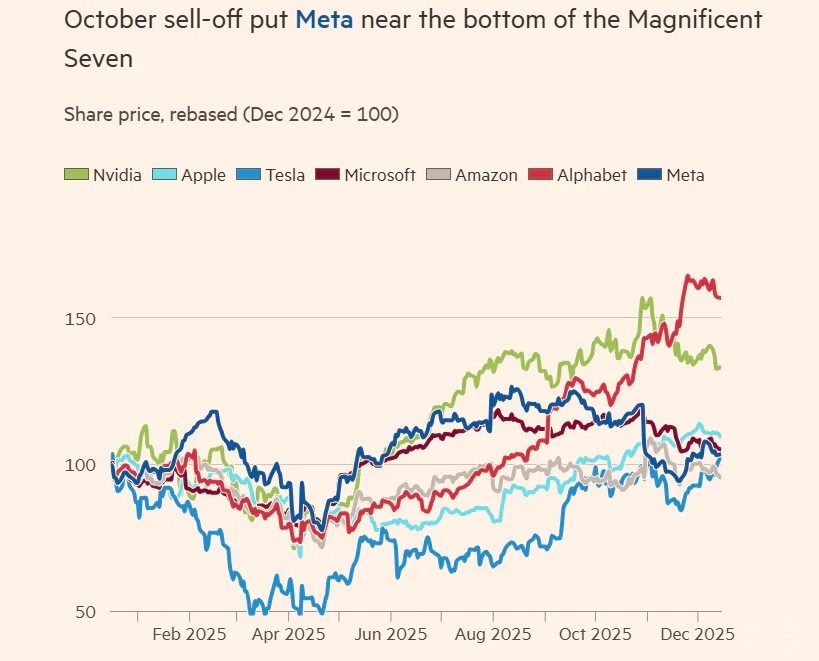

Capital markets quickly realized this was no ordinary “increase in R&D investment,” but a near-maximal reallocation of resources.

Calculations by multiple investment banks show Meta’s free cash flow is undergoing a cliff-like drop: from approximately $54 billion in 2024 to an estimated $20 billion in 2025. In other words, maintaining the current spending pace would nearly deplete Meta’s self-sustaining cash-generating capacity.

This triggered collective anxiety on Wall Street: Should a mature tech giant allocate over two-thirds of its annual revenue to a technology sector that has yet to deliver clear commercial returns?

More unsettling for investors is Meta’s adoption of more complex and controversial financing methods to fund AI expansion. These arrangements ease short-term cash flow pressures but mean the company is staking its financial security for years to come on an unproven technical path.

2. Technical Setback: Llama 4 and the “Emperor’s New Clothes” Moment

In April 2025, Meta made a high-profile launch of its fourth-generation open-source large language model, Llama 4, in San Francisco. Under the stage lights, Zuckerberg reaffirmed Meta’s vision: “Build world-leading AI, open-source it, and benefit the entire world.”

However, post-launch reality quickly dampened this ambition.

Tests by multiple independent evaluation institutions showed Llama 4 failed to achieve industry-leading performance across key capability dimensions, particularly lacking in complex reasoning and engineering capabilities.

More critically, controversy emerged over the fairness of evaluations. Researchers from AI communities like Reddit and Hugging Face discovered significant discrepancies between the model versions Meta submitted to some public leaderboards and those actually available to developers. When third parties attempted to replicate experimental results, performance gaps sparked widespread skepticism.

Meta later issued a statement acknowledging “differences in some evaluation configurations” but denying intentional deception.

II. The AR/VR Hardware Quandary

Beyond AI, Meta’s ambitions in extended reality (XR) hardware face mounting challenges.

Zuckerberg has long believed AR glasses will become the primary interface for human-computer interaction. To this end, Meta is developing next-generation glasses codenamed “Orion,” scheduled for release in late 2026.

Yet experts question whether this will be sufficient. Apple is also reportedly developing AR glasses, potentially launching in 2026. Given Apple’s advantages in hardware design and ecosystem integration, Meta will face brutal competition.

Hardware is just the tip of the iceberg; the real challenge lies in creating killer apps people use daily. Currently, neither Meta nor Apple has demonstrated such applications—and without them, hardware remains an expensive toy.

III. Endgame Scenarios: Meta’s Three Possible Futures in 2026

Strategy set, resources spent, organization reshaped, problems emerged: by the end of 2025, Zuckerberg has no more cards to play. All available capital, recruitments, and risk tolerance have been bet on the 2026 reveal.

Today, Meta stands at a clear crossroads—three distinct paths lie ahead, each leading to a different future.

1. Ideal Outcome: Avocado Takes Off, Meta Makes a Triumphant Return

Assuming Avocado launches successfully in spring 2026, matches Google Gemini 2.5’s performance, reaches or exceeds Gemini 3 levels by summer, and achieves significantly lower costs than competitors, a chain reaction will be triggered.

This outcome will first restore market trust. The core question plaguing Meta—“Will the $100 billion investment pay off?”—will receive a positive answer. Capital market valuation logic will shift from questioning cash burn rates to betting on growth potential.

Second, technological breakthroughs will clear the way for product integration. Previously, Meta AI features in flagship social products like WhatsApp and Instagram were “severely limited” and had “outdated interfaces.” A stronger model foundation will enable true AI integration into Meta’s social ecosystem, from creative tools to advertising systems, forming a sustainable closed loop.

Finally, when AI integration completes its transformation from the largest cost item in financial reports to a new growth engine.

Naturally, in this scenario, Zuckerberg’s radical decisions will be reinterpreted as vision and courage. Even so, regulatory pressures, competitive counterattacks, and security risks will persist—but these issues will be addressed under the premise of success.

2. Middle Scenario: Struggling to Catch Up, Trapped in a War of Attrition

A more likely scenario is a stalemate of “neither failure nor breakthrough.”

If Avocado launches on schedule with acceptable performance but fails to establish a decisive advantage, Meta will struggle to shake OpenAI and Google’s leading positions, remaining only an “alternative option” in the market—a pattern that spells prolonged attrition.

High computing power and R&D investments will suppress profits; limited revenue growth will fail to quickly improve return on investment, while debt and depreciation pressures persist long-term. Organizationally, “intensity” will turn into chronic fatigue.

As breakthroughs remain elusive, core talent may leave after rewards are realized, and Meta’s appeal to top AI researchers will gradually diminish. Along this path, Meta will transition from a high-growth tech pioneer to a large tech company with stable cash flow but limited growth, with its stock price and strategic imagination constrained long-term.

3. Collapse Nightmare: How Far Will Meta Fall If the Gamble Fails?

The worst-case scenario is Avocado failing in terms of performance, security, or compliance.

If the core bet collapses, market confidence could evaporate rapidly. Developers and customers will shift to competing platforms, and public discourse will be dominated by “Meta’s failed gamble.” Capital markets will react directly and harshly.

A stock price slump, credit rating pressure, and soaring debt refinancing costs will force the company into a defensive posture.

In this case, Meta may be forced into large-scale layoffs and strategic contraction—not only derailing AI ambitions but also endangering long-term projects. The company will retreat to its social media core, transforming from a “future-defining company” to a “incumbent giant defending existing business.” This would represent a structural exit, not a short-term setback.

IV. Conclusion: The Reveal

Regardless of the path taken, Meta’s choices in 2025 have placed it at an irreversible historical juncture.

With rare resolve, Zuckerberg has set the company on a one-way course forward. This transformation—from an open-source philosophy to a closed-source gamble—transcends Meta’s own success or failure.

It provides a realistic and costly case study for the entire tech industry: when “all-in AI” becomes the only option, the price is real and irreversible.

In 2026, as Avocado is unveiled, we will witness not only Meta’s fate but also the contours of the next phase of AI competition.

Zuckerberg has bet Meta’s future on AI. Now, it is AI’s turn to decide Meta’s future.

|